Earnings will continue to dominate the news this coming week, although some key events from last week will still need to be monitored. Tech, Biotech, and Financials need to be paid attention too, but perhaps the Dollar may even be more important.

Earnings

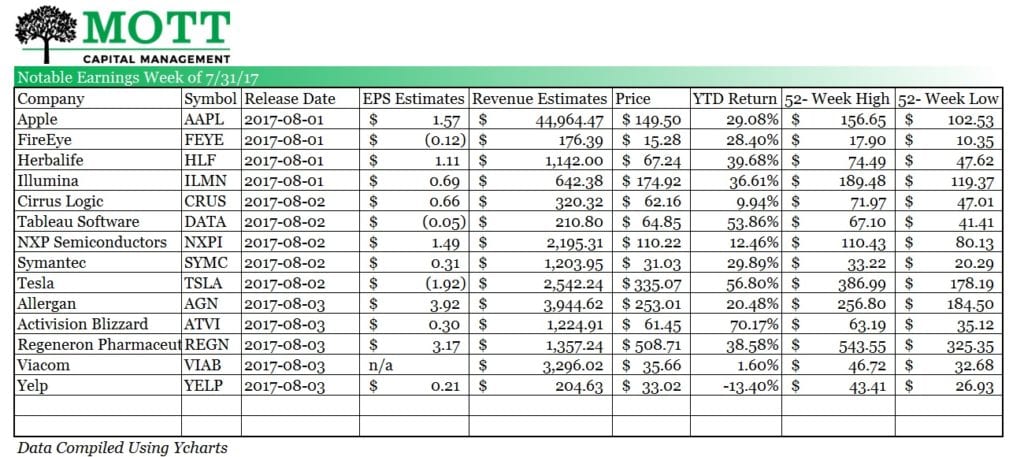

Apple and Tesla are headlining earnings for the week of July 31. This quarter will act as a placeholder for Apple with all eyes turning towards the Fall release of the new iPhone unless the company reports something truly out of left field. Tesla will be all about cash burn, as CAPEX should be high with the launch of the Model 3, but most importantly, delivery guidance for the second half of 2017.

Find out more about our on-demand research product.

Tech and Biotech

Tech (XLK) got walloped on Thursday but stabilized and avoided a further sell-off on Friday. Biotech (IBB) also was lower on Thursday but bounced back nicely on Friday. We need to observe these two sectors, as a further decline in the group could signal investors are starting to move out of the riskier side of the equity market. Despite the sizeable sell-off on Thursday, the two sectors were down less than one percent for the week.

Don’t forget to subscribe to get these reports sent directly to your inbox.

[mailpoet_form id=”2″]

Financials

After breaking out last week, the financials finished the week up only about 50 bps, after being up nearly 2 percent. But the pull back we saw towards the end of the week, appeared to be a bit of filling the gap. This would indicate that banks and the XLF will likely continue to move higher in the near-term.

The Dollar

The Dollar is close to a major breakdown and will need to be watched closely, the 93 level in the Dollar is index critical. A weak Dollar could be bullish for commodities and materials (XLB).

Good Luck!

-Mike

Michael Kramer and the Clients of Mott Capital owns shares of Tesla.

Mott Capital Management, LLC is a registered investment adviser. Information presented is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investments, or investment strategies. Investments involve risk and unless otherwise stated, are not guaranteed. Be sure to first consult with a qualified financial adviser and/or tax professional before implementing any strategy discussed herein. Upon request the advisor will provide a list of all recommendation made during the past twelve months. Past performance is not indicative of future performance.