Subscribe to receive this daily commentary directly in your email

12.13.20

Stocks – AMZN, AVGO, QCOM, FB, GE, CCJ

Macro – SPY

Mike’s Reading The Markets (RTM) Premium Content – NOW WITH A 2 WEEK FREE TRIAL

- Three Potential Paths For The S&P 500 Over The Short-Term- The Week Ahead

- Stocks Drop With More To Come?

- The Calm Before The Storm – Video

- The Calm Before The Storm

- It May Be Another Rough Day For Overvalued Tech

- Stocks Turn Lower, More To Come

- The Snowflake Convexity Squeeze

It will be a busy week for the stock market, especially on Wednesday when the FOMC concludes its meeting and hosts its usual press conference. I am not expecting anything to change with this meeting; I don’t see what the Fed can do to change anything materially. It is possible the Fed could look to increase the purchase of QE, or perhaps do something like an operation Twist, where they sell the shorter-dated Treasury holdings and reinvest the money back into the longer-dated maturities to help control the long end of the curve a bit more.

But at this point, with the 10-Year yield up just 20 bps or so since the last meeting, it doesn’t seem like a time to freak out on that front. But if the Fed wanted to send an aggressive message about keeping rates low, that is one thing they could do.

Additionally, this week will be quadruple witching and the S&P 500 rebalance, along with the addition of Tesla to the index. We will be covering these two things a lot in the subscriber section this week.

S&P 500 (SPY)

This week, the likelihood is that the S&P 500 heads lower, based on the current trends we have been observing. The uptrend in the index is broken, suggesting a drop with the potential to fill a technical gap around 3,620. Should it rise, which is possible on its path to 3,620, there should be firm resistance at 3,680. (Paid subscriber content – Three Potential Paths For The S&P 500 Over The Short-Term- The Week Ahead, the first 2-weeks are free to try).

Daily written analysis, trend identification, market activity reports, and full video access. Recent Analysis

Amazon (AMZN)

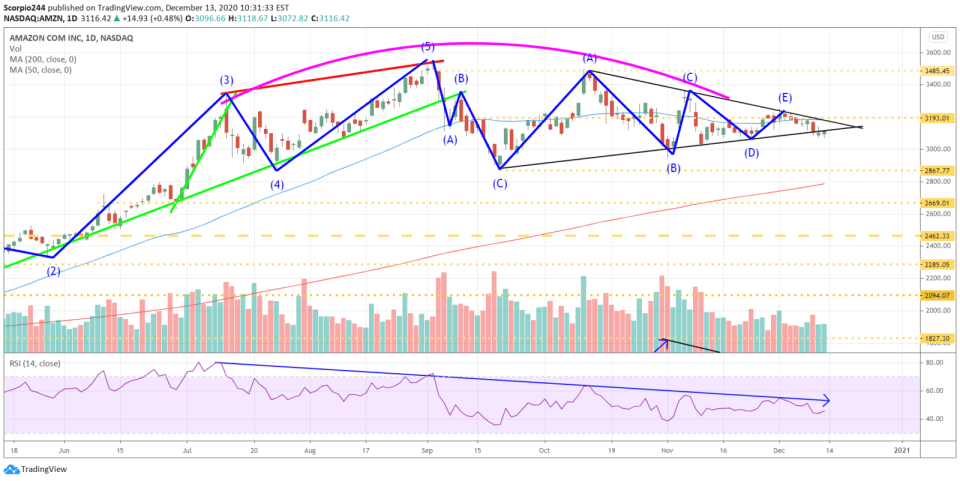

Amazon possesses several bearish patterns, such as a triangle pattern, an RSI that is trending lower, and weaker volume levels. This past week, the stock fell below the uptrend around $3,120, which I think sets up a drop to around 2,870 over the next few weeks.

Broadcom (AVGO)

Broadcom broke an uptrend last week after it reported results. For now, it is holding support around $400, and it would not be surprising to see Broadcom retest the breakdown by rising to around $415 before resuming lower towards $372.

Qualcomm (QCOM)

Qualcomm had a rough Friday, and it may not get any better this week. The news that Apple is essentially cutting Qualcomm out in the future is bad news for the chipmaker. I think this goes back to the original lawsuit Apple filed some time ago, that both sides managed to work out. Apple seems to be intent on buildings its own supply chain, and that means other Apple suppliers should be on notice as well.

If Qualcomm falls below support at $140, it will work to fill that gap at $131. However, I think before that happens, it will refill the gap up at $153. Look for a quick fill-up to $153 this week, following a push lower towards $140 in the weeks to follow.

Facebook (FB)

Facebook has been consolidating sideways more recently and has an RSI trending lower. This would suggest that the stock is likely heading lower. The ABCDE pattern notes the bearish pattern, and a break of support at $273 sets up a drop to around $260.

GE (GE)

The inverse head-and-shoulders proved to be correct in GE, and the run-up may be nearing its end. There is one more gap left to fill, around $12.40, which could be the stock’s next stop. The RSI has a double top, and that likely suggests a change in trend is approaching.

Cameco (CCJ)

Cameco looks like it may have one of those same inverse head and shoulders patterns too. Its next stop could be around $14.50, with support at $12.00.

Have a great week!

-Mike

Mott Capital Management, LLC is a registered investment adviser. Information presented is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investments, or investment strategies. Investments involve risk and, unless otherwise stated, are not guaranteed. Be sure to first consult with a qualified financial adviser and/or tax professional before implementing any strategy discussed herein. Upon request, the advisor will provide a list of all recommendations made during the past twelve months. Past performance is not indicative of future results.

Subscribe to receive this daily commentary directly in your email

This report contains independent commentary to be used for informational and educational purposes only. Michael Kramer is a member and investment adviser representative with Mott Capital Management. Mr. Kramer is not affiliated with this company and does not serve on the board of any related company that issued this stock. All opinions and analyses presented by Michael Kramer in this analysis or market report are solely Michael Kramer’s views. Readers should not treat any opinion, viewpoint, or prediction expressed by Michael Kramer as a specific solicitation or recommendation to buy or sell a particular security or follow a particular strategy. Michael Kramer’s analyses are based upon information and independent research that he considers reliable, but neither Michael Kramer nor Mott Capital Management guarantees its completeness or accuracy, and it should not be relied upon as such. Michael Kramer is not under any obligation to update or correct any information presented in his analyses. Mr. Kramer’s statements, guidance, and opinions are subject to change without notice. Past performance is not indicative of future results. Neither Michael Kramer nor Mott Capital Management guarantees any specific outcome or profit. You should be aware of the real risk of loss in following any strategy or investment commentary presented in this analysis. Strategies or investments discussed may fluctuate in price or value. Investments or strategies mentioned in this analysis may not be suitable for you. This material does not consider your particular investment objectives, financial situation, or needs and is not intended as a recommendation appropriate for you. You must make an independent decision regarding investments or strategies in this analysis. Upon request, the advisor will provide a list of all recommendations made during the past twelve months. Before acting on information in this analysis, you should consider whether it is suitable for your circumstances and strongly consider seeking advice from your own financial or investment adviser to determine the suitability of any investment.

Settlement Dynamics, CTA Flows, and Liquidity Tightening Drive Rising Volatility

Mott Capital's Market Chronicles 4 hours ago