Subscribe to receive this daily commentary directly in your email

January 14, 2020 6PM ET

Stocks – ACAD, TSLA, AMZN, NFLX, INTC

Macro – SPY, IWM

Michael Kramer owns IWM Calls

MICHAEL KRAMER AND THE CLIENTS OF MOTT CAPITAL OWN ACAD, NFLX, AND TSLA

S&P (SPY)

Stocks had a kind of strange day, falling midday on headlines that not all tariffs on China wouldn’t be rolled back until after the election. It resulted in a pretty quick sell-off that the market couldn’t recover.

I’m not sure why this was even newsworthy, to be honest. It was never said that all the tariffs would be rolled back immediately, so why did the market fall? Perhaps it was the dumb algo’s at work.

Regardless absolutely nothing changed from a technical perspective with the S&P 500 well entrenched in the last uptrend off the break out last week.

Daily written analysis, trend identification, market activity reports, and full video access. Recent Analysis

The Russell, on the other hand, had a good day rising by almost 40 basis points to close at 1,675. The Russell rose above the megaphone pattern I have been highlighting and above resistance today, 1,673. I was excited by the price action, and I ran out and bought some Feb calls on the IWM. I felt like a genius for about 30 minutes; then, tariff news took the wind out of my sails. Tomorrow is another day, and I think this one is starting its run higher. Fingers crossed.

Acadia (ACAD)

Acadia’s presentation went off without any issues. I didn’t hear anything that should have resulted in that sharp decline yesterday. The conference today confirmed my view that the MDD trials are running ahead of schedule, with a readout on one coming by the end of the year. The company reiterated that it only needs one more positive MDD trial. The stock recovered some of yesterday’s losses, rising by over 5%. You should be able to watch the replay here.

Tesla (TSLA)

So yesterday, I did the whole video on the re-rating of Tesla’s stock that is occurring. But then I remember prediction 5 for 2019, that Tesla would rise 50% to $500 per share. Just out my prediction fell short by just a couple of days. But anyway, the point is that I was looking at the price to sales multiple. Here are my exact words. Premium Video – The Market Is Re-Rating Tesla’s Stock

The chart below shows that the market may be on the verge of re-rating the stock or restoring its price to sale multiple to its historical trend of about three times sales. Should that happen, the market cap would surge to around $88 billion raising the stock to roughly $492 per share.

Here is the chart:

Could Tesla continue to rise based on the price/sales ratio over the next twelve months? Sure. If revenue over the next-twelve-month is forecast at $28.9 billion and the stock stays in that range of 2.9 to 3.7 times NTM revenue estimates, the stock is likely worth between $83 billion and $107 billion in market cap, which translate to a price of about $455 to $581, assuming 184 million diluted shares outstanding.

With growth ramping up and the question of sustainability out of the story, the stock likely doesn’t deserve to trade at the multiple it traded at for most of 2019. Plus, remember revenue is expected to ramp in 2020 and 2021 so that sales multiple could actually fall, unless the stock continues to rises sharply.

So could shares rise further? Sounds like it.

Amazon (AMZN)

Amazon is back to the uptrend, and now the stock needs to bounce and get above $1900, or the stock is in trouble.

Netflix (NFLX)

Netflix has been struggling around $340; the bears are trying their hardest to contain the stock. Volume levels continue to rise, and the RSI is still pointing to higher prices, and so I think the stock is heading higher in an attempt to fill that gap. Maybe I need more patience.

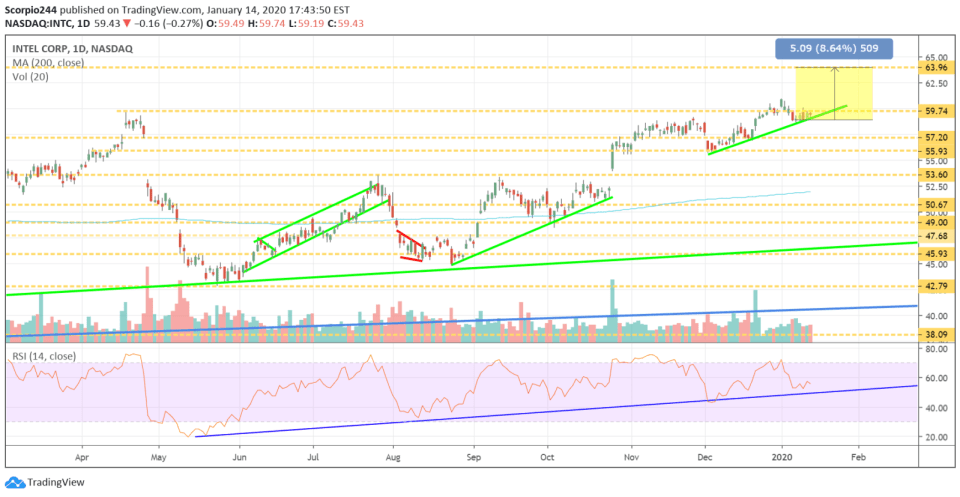

Intel (INTC)

I continue to see more call buying in Intel, so here is a free article up about it. Why A Beat And Raise Quarter May Be On The Horizon

Did I get lazy with that last paragraph? Yeah. Sorry, I’m just out juice today. Too much to do the last few days, and not enough time, therefore not enough sleep.

-Mike

Mott Capital Management, LLC is a registered investment adviser. Information presented is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investments, or investment strategies. Investments involve risk and unless otherwise stated, are not guaranteed. Be sure to first consult with a qualified financial adviser and/or tax professional before implementing any strategy discussed herein. Upon request, the advisor will provide a list of all recommendations made during the past twelve months. Past performance is not indicative of future results.

Subscribe to receive this daily commentary directly in your email

This report contains independent commentary to be used for informational and educational purposes only. Michael Kramer is a member and investment adviser representative with Mott Capital Management. Mr. Kramer is not affiliated with this company and does not serve on the board of any related company that issued this stock. All opinions and analyses presented by Michael Kramer in this analysis or market report are solely Michael Kramer’s views. Readers should not treat any opinion, viewpoint, or prediction expressed by Michael Kramer as a specific solicitation or recommendation to buy or sell a particular security or follow a particular strategy. Michael Kramer’s analyses are based upon information and independent research that he considers reliable, but neither Michael Kramer nor Mott Capital Management guarantees its completeness or accuracy, and it should not be relied upon as such. Michael Kramer is not under any obligation to update or correct any information presented in his analyses. Mr. Kramer’s statements, guidance, and opinions are subject to change without notice. Past performance is not indicative of future results. Neither Michael Kramer nor Mott Capital Management guarantees any specific outcome or profit. You should be aware of the real risk of loss in following any strategy or investment commentary presented in this analysis. Strategies or investments discussed may fluctuate in price or value. Investments or strategies mentioned in this analysis may not be suitable for you. This material does not consider your particular investment objectives, financial situation, or needs and is not intended as a recommendation appropriate for you. You must make an independent decision regarding investments or strategies in this analysis. Upon request, the advisor will provide a list of all recommendations made during the past twelve months. Before acting on information in this analysis, you should consider whether it is suitable for your circumstances and strongly consider seeking advice from your own financial or investment adviser to determine the suitability of any investment.

Volatility Crush Sends Stocks Higher Even As Oil And Rates Surge

Mott Capital's Market Chronicles 5 hours ago