Subscribe to receive this daily commentary directly in your email

MARCH 30, 2020

STOCKS: AAPL, AMZN, UBER, FB

MACRO: SPY, VIX

MICHAEL KRAMER AND THE CLIENTS OF MOTT CAPITAL OWN APPLE

TONIGHT AT 9:00 PM CHINA MANUFACTURING PMI – EST FOR 35.7

Reading The Markets Premium Content – $35/Month or $300/Year

- History Suggests Long-Term Trends For Stocks Still Intact

- Market Still In Prove Me State

- Oil Falls Sharply – Morning Commentary 3.30.20

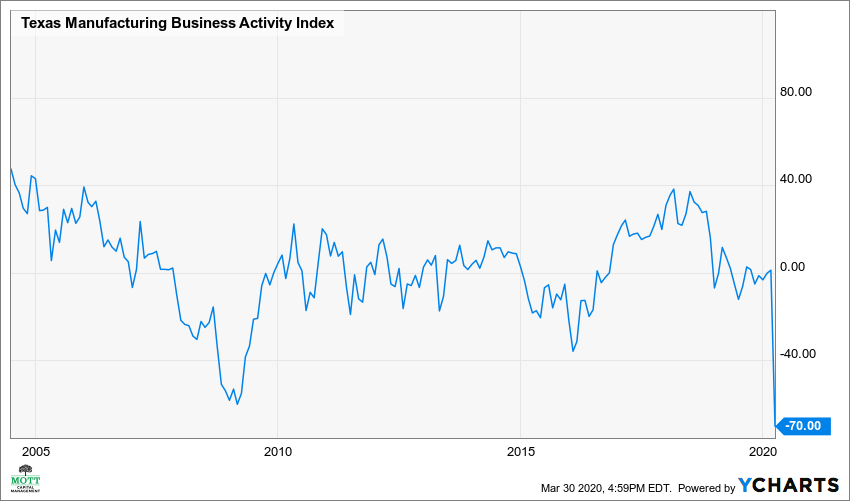

The Dallas Fed reported its manufacturing index for March, and it was the worsts reading on record going back to 2004.

Daily written analysis, trend identification, market activity reports, and full video access. Recent Analysis

But still, stocks rose sharply on Monday, recovering much of what they lost late Friday afternoon. But in reality, the S&P 500 hasn’t gone much of anywhere since March 26, so I would not call today’s rally a win.

An increase above last Thursday close would be a positive and likely result in another leg higher in the market. Perhaps back to 2,720.

The RSI is trending higher, but has also stalled out, while volume levels appear to be in decline. It could be an indicating that the number of buyers are thinning out. It is something that will need to be watched.

VIX

The VIX also came down some today, and that is also a positive sign, falling to 57. Don’t get me wrong, that is still incredibly high, but it is better than nothing.

Oil

Oil fell below $20 briefly today, and there is a good chance now it falls further to perhaps around $17.

I’m still suspicious about this market, the economic data is dreadful, and in most cases worst than 2008 levels. I realize this time may be “different,” but there will be a significant economic fall out from this period. Earnings in 2020 will decline sharply, as company after company pulls its guidance, with RH being the latest after the close tonight.

It could be a case of quarterly rebalancing taking place, helping to push stocks higher, which has likely already started. Now, I never worked at a pension fund, but I have bought 100’s of thousand or even million’s of shares of individual stocks throughout my trading career, and I can tell you that in most cases, this can not be done in one day. So most of this rebalancing process has already started. What will happen on April 1, or even into the close tomorrow when the buy imbalances turn out to be for sale? I do not know.

Amazon (AMZN)

Amazon continues to perform well, with $2000, the next significant level to look for.

Apple (AAPL)

Apple rose today as well but is still unable to get above resistance at $258.

Uber (UBER)

Uber keeps butting up against resistance at $28, with $30.50 the next level to watch. I noted some bullish betting in this one, in a story from earlier today, but the options don’t expire until September.

Facebook (FB)

Facebook has this rising wedge pattern, and that could suggest that the stock is likely to reverse lower towards $148.

Have a good night

-Mike

Mott Capital Management, LLC is a registered investment adviser. Information presented is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investments, or investment strategies. Investments involve risk and unless otherwise stated, are not guaranteed. Be sure to first consult with a qualified financial adviser and/or tax professional before implementing any strategy discussed herein. Upon request, the advisor will provide a list of all recommendations made during the past twelve months. Past performance is not indicative of future results.

Subscribe to receive this daily commentary directly in your email

This report contains independent commentary to be used for informational and educational purposes only. Michael Kramer is a member and investment adviser representative with Mott Capital Management. Mr. Kramer is not affiliated with this company and does not serve on the board of any related company that issued this stock. All opinions and analyses presented by Michael Kramer in this analysis or market report are solely Michael Kramer’s views. Readers should not treat any opinion, viewpoint, or prediction expressed by Michael Kramer as a specific solicitation or recommendation to buy or sell a particular security or follow a particular strategy. Michael Kramer’s analyses are based upon information and independent research that he considers reliable, but neither Michael Kramer nor Mott Capital Management guarantees its completeness or accuracy, and it should not be relied upon as such. Michael Kramer is not under any obligation to update or correct any information presented in his analyses. Mr. Kramer’s statements, guidance, and opinions are subject to change without notice. Past performance is not indicative of future results. Neither Michael Kramer nor Mott Capital Management guarantees any specific outcome or profit. You should be aware of the real risk of loss in following any strategy or investment commentary presented in this analysis. Strategies or investments discussed may fluctuate in price or value. Investments or strategies mentioned in this analysis may not be suitable for you. This material does not consider your particular investment objectives, financial situation, or needs and is not intended as a recommendation appropriate for you. You must make an independent decision regarding investments or strategies in this analysis. Upon request, the advisor will provide a list of all recommendations made during the past twelve months. Before acting on information in this analysis, you should consider whether it is suitable for your circumstances and strongly consider seeking advice from your own financial or investment adviser to determine the suitability of any investment.

Volatility Crush Sends Stocks Higher Even As Oil And Rates Surge

Mott Capital's Market Chronicles 8 hours ago