Subscribe to receive this daily commentary directly in your email

January 17, 2020

Stocks: QCOM, NVDA, CSCO, SQ, FCX

Macro: SPY, IWM

Reading The Markets Premium Content – The First 2-Weeks Are Free To Try

- Stock Are Pushing The Boundaries

- How I Developed My S&P 500 3600 And Russell 1700 Target In October

- Rapid Update On Intel

- Options Ex Ahead Of 3-Day Weekend- Morning Commentary 1.17.20

- Webcast Replay

MICHAEL KRAMER OWN IWM CALLS

MICHAEL KRAMER AND THE CLIENTS OF MOTT CAPITAL OWN CSCO

Sorry for not sending the morning write-up. I was tired from the night before, after the webcast. It was a good session, went over a lot of good materials, and had a lot of good questions. Thank you for those that participated. You can watch the replay here- The first two weeks are free to try. Webcast Replay

S&P 500 (SPY)

Stocks finished January 17 higher again, but the boundaries and the distance left to travel given the projected rise are now near their limits.

I have taken a look at the current trends in the S&P, and the index appears to be returning to a path laid out before the fourth quarter 2018 meltdown. The channel started in February 2016, and it has been something I have tracked for almost 4 years now, and to some degree, I had stopped talking about it because, for a time, it became irrelevant. But it seems there is a reversion of sorts taking place, and it has become relevant again.

Again this chart would suggest that over the longer-term, the index is likely to continue to climb. Perhaps even climbing to levels well beyond 3,500 towards 3,600.

Additionally, you can see in the RSI panel, the trend of the blue lines. We can see the double bottom in RSI that was created in 2018. It marked a change in the longer-term direction of the index from falling momentum to rising momentum. In this case, it likely suggests to me that we still in the relatively early stage of a longer-term momentum shift higher, as these trends tend to last about 2 years from what I can tell.

Daily written analysis, trend identification, market activity reports, and full video access. Recent Analysis

However, the index continues to be overbought and currently does need to pull back some. We have been tracking a short-term trading channel since the beginning of October, and at this point, we are at the upper end of the channel, and it would suggest a reversion back to the lower end, placing the index in a range of 3216 to 3250.

There is also the rising wedge pattern to contend with, which I believe is in the bump-out phase.

Additionally, the RSI is once again at overbought levels around 76.5.

And, I also noted some more buying of VIX calls today, which I spoke about in the premium morning commentary, never miss an update- Options Ex Ahead Of 3-Day Weekend- Morning Commentary 1.17.20

Again, long-term trends are higher. Short-term meaning next few days to weeks is likely lower.

Russell (IWM)

The Russell hit resistance today and backed off falling by 33 bps. It prompted me to buy some Feb IWM puts. There is a gap to fill to 1673, the point of the breakout.

Qualcomm (QCOM)

Qualcomm had a good day after getting positive comments from Citigroup and a price target increase. I had noted yesterday in the midday update that I thought might be heading higher towards $101. Premium content- Technology Sector Now Has Bearish Pattern

Nvidia (NVDA)

Nvidia has a nice looking chart currently, and I noted in a free article today, that I thought the stock could rise to around $168. I also saw an excellent spread trade, which indicates the stock goes higher as well after earnings. Bets Being Placed Nvidia Rises Following Results

Freeport (FCX)

I had seen some bullish betting in Freeport on Wednesday, and I had thought a flag pattern was forming in the chart. Well, the flag pattern is holding on for dear life, and a lot of where the stock goes is going to depend on copper. Premium content – Bullish Betting On Freeport As Copper Surges And Dollar Sinks

Cisco (CSCO)

Say it ain’t so Cisco broke out yesterday, and I missed it. It opens the possibility for the stock to push towards $50.25

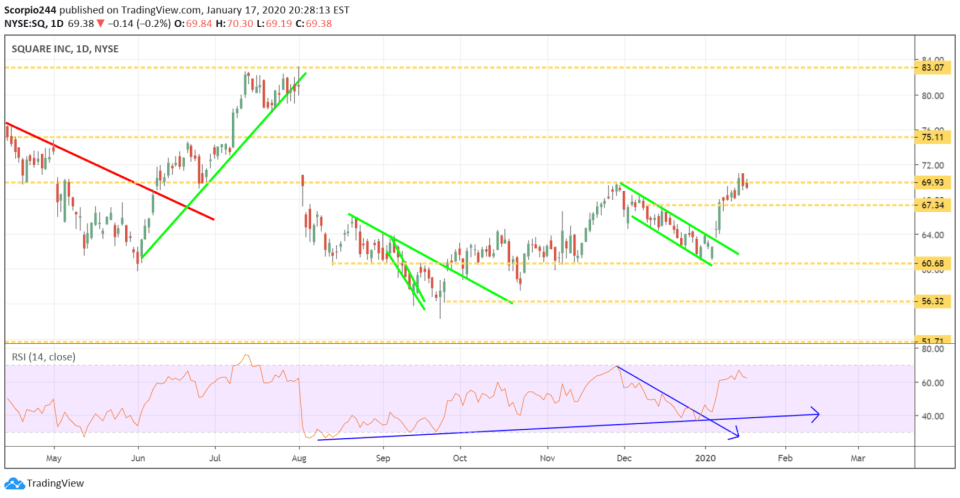

Square (SQ)

Square is trying to break out and fill the gap, but it can’t get past this resistance region at $70. So we will have to see what next week will bring. I know the options traders were betting it would rise by as much as 21%, when I first noted it would jump back on January 2. Premium content- Square May Rise On Bullish Betting

-Mike

Subscribe to receive this daily commentary directly in your email

This report contains independent commentary to be used for informational and educational purposes only. Michael Kramer is a member and investment adviser representative with Mott Capital Management. Mr. Kramer is not affiliated with this company and does not serve on the board of any related company that issued this stock. All opinions and analyses presented by Michael Kramer in this analysis or market report are solely Michael Kramer’s views. Readers should not treat any opinion, viewpoint, or prediction expressed by Michael Kramer as a specific solicitation or recommendation to buy or sell a particular security or follow a particular strategy. Michael Kramer’s analyses are based upon information and independent research that he considers reliable, but neither Michael Kramer nor Mott Capital Management guarantees its completeness or accuracy, and it should not be relied upon as such. Michael Kramer is not under any obligation to update or correct any information presented in his analyses. Mr. Kramer’s statements, guidance, and opinions are subject to change without notice. Past performance is not indicative of future results. Neither Michael Kramer nor Mott Capital Management guarantees any specific outcome or profit. You should be aware of the real risk of loss in following any strategy or investment commentary presented in this analysis. Strategies or investments discussed may fluctuate in price or value. Investments or strategies mentioned in this analysis may not be suitable for you. This material does not consider your particular investment objectives, financial situation, or needs and is not intended as a recommendation appropriate for you. You must make an independent decision regarding investments or strategies in this analysis. Upon request, the advisor will provide a list of all recommendations made during the past twelve months. Before acting on information in this analysis, you should consider whether it is suitable for your circumstances and strongly consider seeking advice from your own financial or investment adviser to determine the suitability of any investment.

Volatility Crush Sends Stocks Higher Even As Oil And Rates Surge

Mott Capital's Market Chronicles 6 hours ago