Subscribe to receive this daily commentary directly in your email

May 25, 2021

STOCKS – NVDA, SLV

MACRO – SPY, IWM

Mike’s Reading The Markets (RTM) Premium Content – FREE 2-WEEK TRIAL

- RTM – Betting Silver Rises And Micron Falls

- RTM: Big Inflection Point For Stock On Turnaround Tuesday

- RTM – Strong Technical Trends

- RTM Tactical Update – Lower Stocks And Higher Yields May Be Coming

- Relative Performance Charts 5.21.21

- Webcast Replay

- RTM – Next Week Should Give A Better Sense Of Direction

- RTM Tactical Update – It May Be Time To Look For “Value” Among Growth Stocks

I’m out of juice today. This one is going to be really short; maybe it is the nice weather. It feels like a nice summer’s day out on eastern Long Island, I feel like doing absolutely nothing this afternoon. Anyway…

Stocks finished the day pretty much flat today, with the S&P 500 up about 15 bps, while the Qs finished the day higher by 30 bps. Right now, we appear to be in a holding pattern, at least for today. That may change tomorrow with jobless claims and durable good order along with a second read on 1Q GDP.

The pattern in the S&P 500 futures suggests that we still see some more downside, with a push to around 4,155. The VIX was down almost 8% today, and there was no lift to the S&P 500; on a day when falling implied volatility should have lifted equities, it didn’t. I would actually view that as negative for stocks overall. It has been very rate over the past year and a half to see a day like today.

The volume also disappeared today, with the SPY ETF seeing its lowest levels since the middle of February. Maybe I was not the only feeling like being on summer vacation.

Daily written analysis, trend identification, market activity reports, and full video access. Recent Analysis

Based on the VIX and low volume day, one would have expected the bulls to be firmly in charge. They clearly weren’t, and this does suggest something.

The S&P 500 continues to hold the March 2020 uptrend. However, I was able to put in a downtrend for the index today for the first time. If this trend is correct, coupled with what I think could be the start of a Wave 3 lower, we could see sharply lower prices in the days ahead. Starting tomorrow, the economic data picks up materially.

Russell 2000 (IWM)

The Russell surged today by 2%, continuing the confusion that is this index every day. At times it seems to have no sense of direction. I’m going to try to take another look at this tomorrow and see. Right now, the index got stuck at Monday’s highs.

Nvidia (NVDA)

Anyway, Nvidia reported better than expected results; no surprise there, it always does. The stock is trading down after the results, though, which would seem surprising, but when you dig into the numbers, while they beat the mean estimates, most of the numbers and guidance missed the street high estimates, which seems to be what investors in this market seem to be looking for. We saw the same thing with Amazon. If that is the case, the stock can trade lower because beating the mean is not good enough these days. Stocks that don’t go up after good earnings because they aren’t good enough, have only one way to go, which is probably lower.

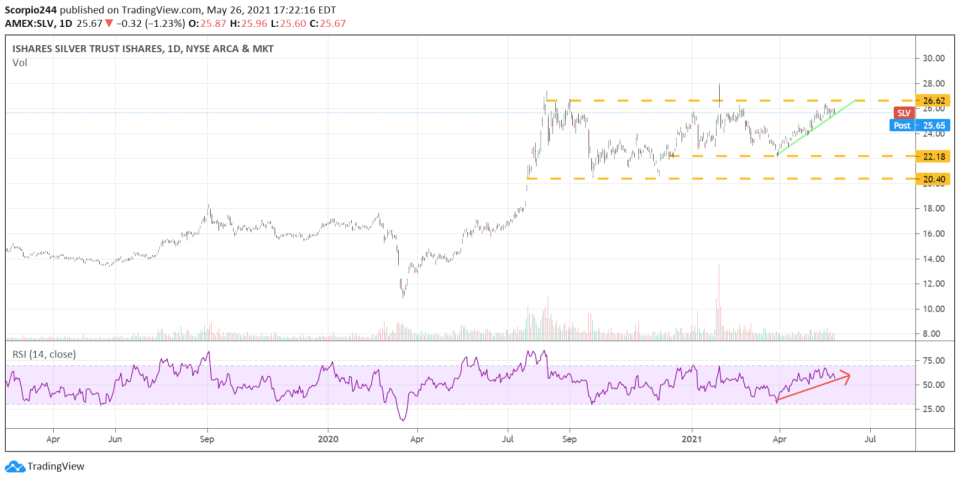

Silver (SLV)

Silver prices could be heading much higher, yeah, I said Silver. There were some really big bullish bets in the SLV ETF that showed on this morning’s open interest change reports. The calls for the September 30 for the $32 strike were being bought. The chart certainly suggests a big move could be ahead of the SLV ETF, if it can get over $26.60.

Anyway, I am out of juice today, so that’s it.

-Mike

Mott Capital Management, LLC is a registered investment adviser. Information presented is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investments, or investment strategies. Investments involve risk and, unless otherwise stated, are not guaranteed. Be sure to first consult with a qualified financial adviser and/or tax professional before implementing any strategy discussed herein. Upon request, the advisor will provide a list of all recommendations made during the past twelve months. Past performance is not indicative of future results.

Subscribe to receive this daily commentary directly in your email

This report contains independent commentary to be used for informational and educational purposes only. Michael Kramer is a member and investment adviser representative with Mott Capital Management. Mr. Kramer is not affiliated with this company and does not serve on the board of any related company that issued this stock. All opinions and analyses presented by Michael Kramer in this analysis or market report are solely Michael Kramer’s views. Readers should not treat any opinion, viewpoint, or prediction expressed by Michael Kramer as a specific solicitation or recommendation to buy or sell a particular security or follow a particular strategy. Michael Kramer’s analyses are based upon information and independent research that he considers reliable, but neither Michael Kramer nor Mott Capital Management guarantees its completeness or accuracy, and it should not be relied upon as such. Michael Kramer is not under any obligation to update or correct any information presented in his analyses. Mr. Kramer’s statements, guidance, and opinions are subject to change without notice. Past performance is not indicative of future results. Neither Michael Kramer nor Mott Capital Management guarantees any specific outcome or profit. You should be aware of the real risk of loss in following any strategy or investment commentary presented in this analysis. Strategies or investments discussed may fluctuate in price or value. Investments or strategies mentioned in this analysis may not be suitable for you. This material does not consider your particular investment objectives, financial situation, or needs and is not intended as a recommendation appropriate for you. You must make an independent decision regarding investments or strategies in this analysis. Upon request, the advisor will provide a list of all recommendations made during the past twelve months. Before acting on information in this analysis, you should consider whether it is suitable for your circumstances and strongly consider seeking advice from your own financial or investment adviser to determine the suitability of any investment.

The World Awaits Nvidia's Results

Mott Capital's Market Chronicles 22 hours ago