Subscribe to receive this daily commentary directly in your email

MAY 11, 2020

STOCKS – PYPL, AMZN, FB, NVDA, CRM

MACRO – SPY, QQQ

LONG-TERM TRENDS – CAUTIOUS

MIKE’S PREMIUM READING THE MARKET CONTENT $35/Month or $300/Yera :

- Stock Inch Back Positive – Midday

- JPMorgan Options Traders Betting On Steeper Declines

- Growing More Cautious Short-Term – Morning Commentary

- What Would Turn Me From Bearish To Bullish

- Sectors And ETF’s Sending Warnings

The S&P 500 finished the day in the place it started, up just one basis point. It wasn’t a dull day by any means, with the S&P 500 opening sharply lower only to gain all the losses back, rising sharply, and finish the day at 2,930.

S&P 500 (SPY)

The 2,940 level appears to be a stiff level of resistance for now, and we will need to watch how this level performs tomorrow if tested again. At least for today, the index tested resistance on two occasions, only to fail each time, creating an intraday double top. Not sure that it matters given it is only on the intraday chart, but interesting none the less.

Support for the S&P 500 comes at 2917, with resistance at 2940 and then 2955.

Daily written analysis, trend identification, market activity reports, and full video access. Recent Analysis

Qs (QQQ)

Meanwhile, the Qs just keep rising in this super-tight range that has been in place for 6 days. The RSI is now 65, and it seems like the Q’s have a target to complete the gap fill up at $230. What happens after that is all that matters because we know what tends to happen once gaps are filled.

Amazon (AMZN)

The amazing thing is that the increase in the Qs is happening all without Amazon because the stock has gone nowhere since April 16.

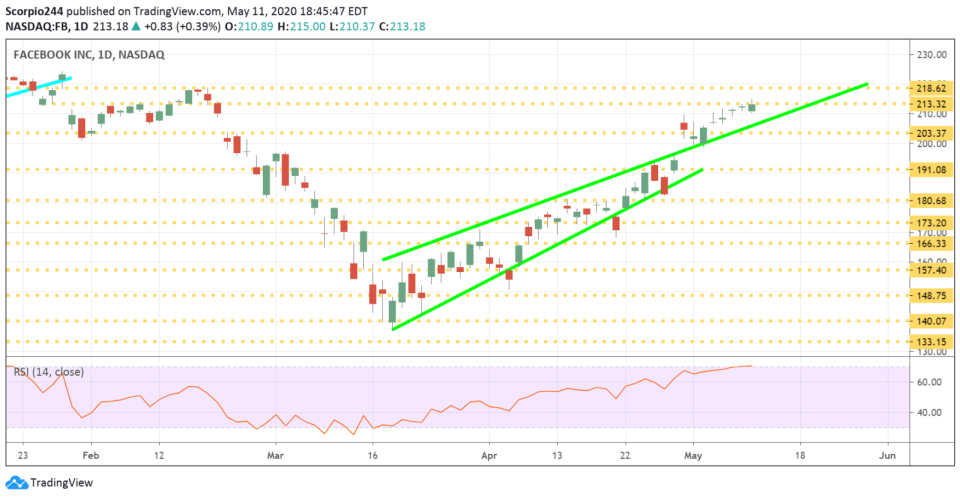

Facebook (FB)

Facebook rose to around resistance today and failed to push through meaningfully. Also, the stock still has an RSI that suggests it is overbought, and I thank that means shares pullback to $191.

Salesforce (CRM)

Salesforces is also back to resistance at $182 and has an RSI rising over 70. A pullback to $166 would be healthy.

PayPal (PYPL)

How is PayPal trading at an all-time when analysts are slashing their earnings and revenue estimates for the company, while the stock is trading with its highest one-year forward PE ratio since 2017. I don’t know. I get the whole digital transaction things, trust me, but still. There is a nice gap-fill still linger around $120.

Nvidia (NVDA)

I can’t believe Nvidia made a new all-time high today. The company hasn’t reported results yet, and AMD and INTC have struggled to move up in recent days. Even the SMH hasn’t been moving up, extraordinary price action. Again, another stock reaching the upper limits.

Anyway, these are all in the NASDAQ 100, so you know happens if these stocks go. Just sayin’…

-Mike

Mott Capital Management, LLC is a registered investment adviser. Information presented is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investments, or investment strategies. Investments involve risk and, unless otherwise stated, are not guaranteed. Be sure to first consult with a qualified financial adviser and/or tax professional before implementing any strategy discussed herein. Upon request, the advisor will provide a list of all recommendations made during the past twelve months. Past performance is not indicative of future results.

Subscribe to receive this daily commentary directly in your email

This report contains independent commentary to be used for informational and educational purposes only. Michael Kramer is a member and investment adviser representative with Mott Capital Management. Mr. Kramer is not affiliated with this company and does not serve on the board of any related company that issued this stock. All opinions and analyses presented by Michael Kramer in this analysis or market report are solely Michael Kramer’s views. Readers should not treat any opinion, viewpoint, or prediction expressed by Michael Kramer as a specific solicitation or recommendation to buy or sell a particular security or follow a particular strategy. Michael Kramer’s analyses are based upon information and independent research that he considers reliable, but neither Michael Kramer nor Mott Capital Management guarantees its completeness or accuracy, and it should not be relied upon as such. Michael Kramer is not under any obligation to update or correct any information presented in his analyses. Mr. Kramer’s statements, guidance, and opinions are subject to change without notice. Past performance is not indicative of future results. Neither Michael Kramer nor Mott Capital Management guarantees any specific outcome or profit. You should be aware of the real risk of loss in following any strategy or investment commentary presented in this analysis. Strategies or investments discussed may fluctuate in price or value. Investments or strategies mentioned in this analysis may not be suitable for you. This material does not consider your particular investment objectives, financial situation, or needs and is not intended as a recommendation appropriate for you. You must make an independent decision regarding investments or strategies in this analysis. Upon request, the advisor will provide a list of all recommendations made during the past twelve months. Before acting on information in this analysis, you should consider whether it is suitable for your circumstances and strongly consider seeking advice from your own financial or investment adviser to determine the suitability of any investment.

Volatility Crush Sends Stocks Higher Even As Oil And Rates Surge

Mott Capital's Market Chronicles 9 hours ago