Subscribe to receive this daily commentary directly in your email

June 26, 2020

STOCKS – NKE, TSLA, DIS, AMD

MACRO – SPY, QQQ, HYG

Mike Reading The Markets Premium Content – $35/Month or $300/Year

- Stock Testing Critical Resistance

- Stocks Face A Challenging And Important Day – Morning

- Betting On A 10% Drop In AT&T

- Nasdaq 100 May See A Sharp Reversal Short-Term

- Betting Indicates Facebook Falls

- The New Week Faces Headwinds – Morning

MICHAEL KRAMER AND THE CLIENTS OF MOTT CAPITAL OWN TESLA

Overnight trading continues to remain volatile with the S&P 500 Futures reaching resistance at 3080, and falling to support around 3,050. Currently, futures are trading near the upper end of the trading range, but again, it suggests that 3050 for now, will be our support level for the day. It was a severe level of resistance for nearly all day yesterday.

At this point, heading into the final days of June, the seasonal headwinds continue not to favor stocks rising. However, the fact that the drawdown has been so mild to this point may be a big positive going into July. So we will need to continue to monitor this. Where we close to today, likely depends on investors’ appetite going long into the weekend. I’m not sure I would if I traded daily. I’d expect to get a retest of support at 3050 today, if not a breakdown.

However, the most significant risk on the horizon over the near term is what the Federal government will do when the PPP expires at the end of July. This could be one thing that gives the market a problem this summer if lawmakers drag their feet.

Daily written analysis, trend identification, market activity reports, and full video access. Recent Analysis

NASDAQ (QQQ)

For the Qs, the only thing that matters is $240. As long as that level holds, the trend is still higher.

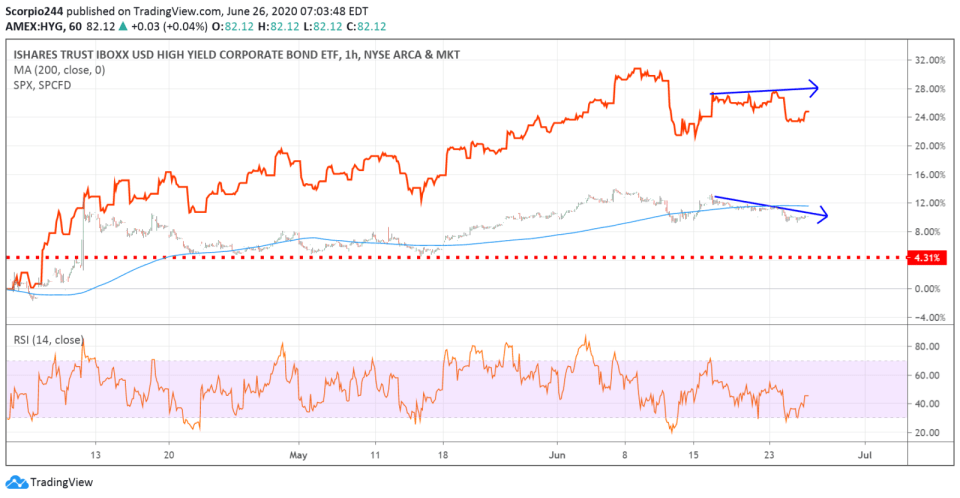

High Yield (HYG)

Keep an eye on the HYG ETF; it seems that two are diverging just a bit the last few weeks.

Nike (NKE)

Nike is falling today after reporting weaker than expected results last night. The stock has done a fantastic job of holding support at $97. That is the critical level for the stock to hold today, with the risk of sharing falling back to $88.50.

Tesla (TSLA)

Tesla has been moving higher and, more importantly, it is holding that uptrend. It seems it may be forming an ascending triangle, with the potential for shares to push higher over the next few weeks to around $1265.

AMD (AMD)

AMD fell below support at $53, and AMD needs to get back above $53 today. Otherwise, the stock may be heading lower from here; the RSI suggests it does fall.

Disney (DIS)

Disney is sitting on support at $109, and it has to hold that level. If that level cracks, the stock is likely falling to $99. The RSI is breaking down.

Have a great Friday

-Mike

Mott Capital Management, LLC is a registered investment adviser. Information presented is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investments, or investment strategies. Investments involve risk and, unless otherwise stated, are not guaranteed. Be sure to first consult with a qualified financial adviser and/or tax professional before implementing any strategy discussed herein. Upon request, the advisor will provide a list of all recommendations made during the past twelve months. Past performance is not indicative of future results.

Subscribe to receive this daily commentary directly in your email

This report contains independent commentary to be used for informational and educational purposes only. Michael Kramer is a member and investment adviser representative with Mott Capital Management. Mr. Kramer is not affiliated with this company and does not serve on the board of any related company that issued this stock. All opinions and analyses presented by Michael Kramer in this analysis or market report are solely Michael Kramer’s views. Readers should not treat any opinion, viewpoint, or prediction expressed by Michael Kramer as a specific solicitation or recommendation to buy or sell a particular security or follow a particular strategy. Michael Kramer’s analyses are based upon information and independent research that he considers reliable, but neither Michael Kramer nor Mott Capital Management guarantees its completeness or accuracy, and it should not be relied upon as such. Michael Kramer is not under any obligation to update or correct any information presented in his analyses. Mr. Kramer’s statements, guidance, and opinions are subject to change without notice. Past performance is not indicative of future results. Neither Michael Kramer nor Mott Capital Management guarantees any specific outcome or profit. You should be aware of the real risk of loss in following any strategy or investment commentary presented in this analysis. Strategies or investments discussed may fluctuate in price or value. Investments or strategies mentioned in this analysis may not be suitable for you. This material does not consider your particular investment objectives, financial situation, or needs and is not intended as a recommendation appropriate for you. You must make an independent decision regarding investments or strategies in this analysis. Upon request, the advisor will provide a list of all recommendations made during the past twelve months. Before acting on information in this analysis, you should consider whether it is suitable for your circumstances and strongly consider seeking advice from your own financial or investment adviser to determine the suitability of any investment.

Volatility Crush Sends Stocks Higher Even As Oil And Rates Surge

Mott Capital's Market Chronicles 8 hours ago