June 4 – Stock Mentions: AAPL, SQ, MA, PYPL, CRM,

Michael Kramer and the clients of Mott Capital own AAPL and MA

June 4 Is A Turning Point

Well, I can’t say it didn’t go as expected, just not the way I would have liked to go down. I said this morning that there was a bullish reversal pattern that was forming in the S&P 500 and to this point, that pattern is still holding at supports at 2,737, barely. However, the S&P 500 managed to close off the lows at 2,744.

I think mostly the market is getting blindsided by the turn of events with trade, and now the DOJ probes into some of these tech giants like Facebook and Alphabet. I’m sorry, but if Google and Facebook continue having days like today, the indexes will find it very hard to lift.

The only piece of good news is that the turn around in the S&P 500 is due to happen on June 4 (tomorrow) around 12:30 PM or earlier. That is when the downtrend and the support level at 2,737 crosses. At that point, we find out if we can reverse higher or are set to plunge to lower lows — critical.

You can see we closed right at the downtrend. What’s my guess on where we go? Sure. Since you are twisting my arm. I say we break the downtrend and rise to 2,770 –why not. (premium content: Are We Any Closer To A Bottom?)

Nasdaq (QQQ)

Let’s hope that the S&P 500 doesn’t follow the path of the NASDAQ because that would mean the S&P 500 still has further to fall. The NASDAQ is now in correction territory down nearly 11% from its May 1 highs. A drop below 7,300 opens the door to 7,180.

Semis (SMH)

We keep talking about the SMH, but it continues to hold up, again I tend to lean on the groups that fell the hardest and fell the fastest. So while the broader market feels horrible, there are reasons to be hopeful, but not many.

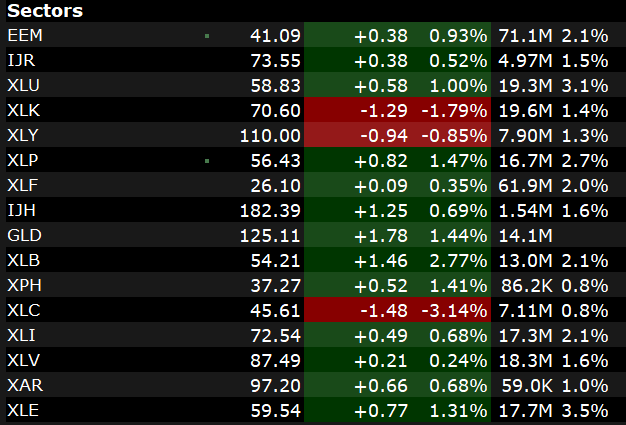

Sectors

But when we look a the broader market outside of tech, it wasn’t that bad of a day.

(Interactive Brokers TWS)

When we think about today’s move lower, we can blame it mostly on technology. Interesting to note at least.

Yields

At this point, it looks yields may have a bit further to fall, perhaps to as much as 2%, which is what I have been saying for some time. We got to as low as 2.06% today. All-in-all we are near a bottom atleast over the short-term.

Apple (AAPL)

Apple continues to trend lower, but I continue to believe that it is due to rebound. I wrote about today in a premium column, but a close below $172 would likely force me to change my mind. Apple May Be Overdue For A Bounce

Square (SQ)

Square broke down today and fell below support $62, and that may set up a decline to $56.60. It was on May 13 in the premium area I noted square looked lousy. Square Is Now Breaking Down

Salesforce (CRM)

Salesforce broke key support today at $149 and now could be on pace to drop to $138. Not a good sign for the stock heading into results. The RSI suggests there is further to fall.

I can’t send to figure out why Mastercard and Paypal got hammered today.

Mastercard (MA)

Mastercard fell right to support at $241.

PayPal (PYPL)

Paypal fell to support at $104.

The good news is that both bounced, but still a lot of damage was done.

Let hope tomorrow is better.

-Mike

Mott Capital Management, LLC is a registered investment adviser. Information presented is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investments, or investment strategies. Investments involve risk and unless otherwise stated, are not guaranteed. Be sure to first consult with a qualified financial adviser and/or tax professional before implementing any strategy discussed herein. Upon request, the advisor will provide a list of all recommendations made during the past twelve months. Past performance is not indicative of future results.