Subscribe to receive this daily commentary directly in your email

STOCKS – NFLX, FB, ORCL, BABA

MACRO – SPY, XBI

Mike Reading The Markets Premium Content – $35/Month or $300/Year

- For Live Webinar On 6/18

- Trying To Break Free – Midday

- Big Break Set To Happen Today

- Just Fillin’ Gaps Or Something More?

- Uber May See A Steep Decline

- Stocks Are Set To Sink – Morning

- A Massive Week Lies Ahead For The Stock Market

S&P 500 (SPY)

It turned out to be a pretty wild day, not all that different then what I expected. The S&P 500 index finished the day nearly 90 basis points off its highs, to close the day down by 36 basis points. Something is going on at the 3140 level in the S&P 500, which is acting as a firm-level of resistance during the last two days. Perhaps it has something to do with options expiration on Friday, but it seems the buyers tried mightly to break that level a handful of times and have been unsuccessful. By the day’s end, it just seemed like the buyers were outnumbered and overwhelmed, and the market drifted lower.

Volume levels in the SPY have been drifting lower since Tuesday morning, a sign that the number of buyers was thinning. Meanwhile, volume accelerated on the late-day decline, suggesting sellers took over. I would not rule out a pullback tomorrow to $306 on the SPY.

(Excluding ext. hours)

Daily written analysis, trend identification, market activity reports, and full video access. Recent Analysis

Even the downtrend I pointed yesterday is still enforced, with the SPY failing right at it early today.

(including ext. hours)

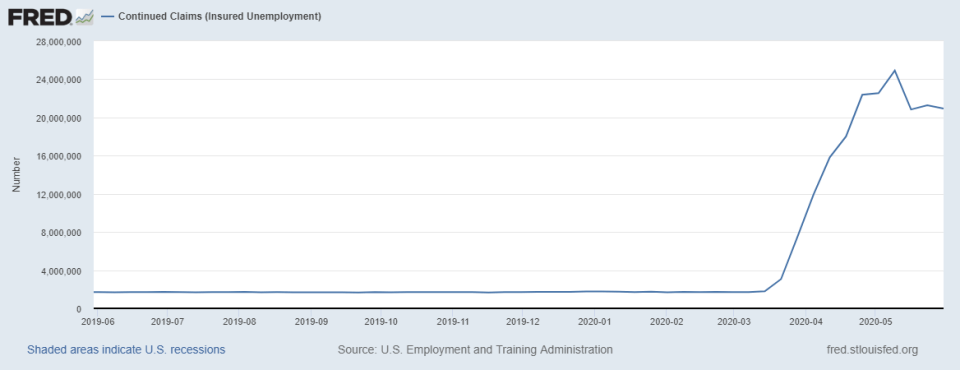

Tomorrow will, of course, be, initial and continuing jobless claims. At this point, the continuing claims appear to be the more important number to follow, as it gives a better sense of how many people are returning to work. In the last three weeks, we have been stuck around 21 million. Should claims rise above that level, it would not be viewed as a positive by the markets, as it would suggest that not many people are returning to work. A drop below 20 million would likely be considered to be positive and play into the reopening is going great trade.

Netflix (NFLX)

Netflix has a pattern that looks awfully like a head and shoulders. It also has a declining volume pattern from left to right and an RSI that is trending lower. All a telltale sign of that pattern. So I think this is important for two reasons, one that the stock potentially goes significantly lower. Two, because it seems it is very much a bullish sentiment trade.

Alibaba (BABA)

Alibaba has been steadily trending higher, and I noticed some bullish betting in it this morning. For now, the first level of resistance comes at $232. You can read more in this free article I wrote- Alibaba’s Advance Is Likely To Push On

Facebook (FB)

Facebook got pinned down at $237.50 today, and as I noted yesterday, I think this one goes lower, potentially back to $203.

Oracle (ORCL)

Oracle managed to hold on to support in that $51-52 region. That is a significant support level.

Biotech ETF (XBI)

It looks someone doesn’t want the XBI rising above $105.50. The RSI is trending lower. Therefore a move lower for the ETF may be coming soon. I’d watch that $105.50 level very carefully.

Have a good one

-mike

Mott Capital Management, LLC is a registered investment adviser. Information presented is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investments, or investment strategies. Investments involve risk and, unless otherwise stated, are not guaranteed. Be sure to first consult with a qualified financial adviser and/or tax professional before implementing any strategy discussed herein. Upon request, the advisor will provide a list of all recommendations made during the past twelve months. Past performance is not indicative of future results.

Subscribe to receive this daily commentary directly in your email

This report contains independent commentary to be used for informational and educational purposes only. Michael Kramer is a member and investment adviser representative with Mott Capital Management. Mr. Kramer is not affiliated with this company and does not serve on the board of any related company that issued this stock. All opinions and analyses presented by Michael Kramer in this analysis or market report are solely Michael Kramer’s views. Readers should not treat any opinion, viewpoint, or prediction expressed by Michael Kramer as a specific solicitation or recommendation to buy or sell a particular security or follow a particular strategy. Michael Kramer’s analyses are based upon information and independent research that he considers reliable, but neither Michael Kramer nor Mott Capital Management guarantees its completeness or accuracy, and it should not be relied upon as such. Michael Kramer is not under any obligation to update or correct any information presented in his analyses. Mr. Kramer’s statements, guidance, and opinions are subject to change without notice. Past performance is not indicative of future results. Neither Michael Kramer nor Mott Capital Management guarantees any specific outcome or profit. You should be aware of the real risk of loss in following any strategy or investment commentary presented in this analysis. Strategies or investments discussed may fluctuate in price or value. Investments or strategies mentioned in this analysis may not be suitable for you. This material does not consider your particular investment objectives, financial situation, or needs and is not intended as a recommendation appropriate for you. You must make an independent decision regarding investments or strategies in this analysis. Upon request, the advisor will provide a list of all recommendations made during the past twelve months. Before acting on information in this analysis, you should consider whether it is suitable for your circumstances and strongly consider seeking advice from your own financial or investment adviser to determine the suitability of any investment.

The Next Leg Lower Nears...

Mott Capital's Market Chronicles February 27, 2026 1:57 PM