Subscribe to receive this daily commentary directly in your email

January 7, 2020

Stocks: MU, WDC, NFLX, M, SQ

Macro: SPY, Economics

US Markets

- S&P 500 Futures +4 points

- US 10-Year 1.81%

- Dollar Index 96.80

- VIX 13.85

- Oil $62.94

International Markets

- Japan +1.6%

- HK +0.34%

- Shanghai +0.69%

- SK +0.95%

- Germany +1.08%

- UK +0.15%

MICHAEL KRAMER AND THE CLIENTS OF MOTT CAPITAL OWN NFLX

Mott Capital’s Reading The Markets Premium Content, Get The First 2-Weeks Free to Try It, Cancel If You Hate It!

- Subscriber Mailbag – Looking At Fundamentals

- First Live Webinar – Jan 16 9:30 PM EST

- Stocks May Merely Be Filling The Gap

- MORNING COMMENTARY 1.6.20

- Sector Rotation On Watch For The Week Of January 6

S&P 500 (SPY)

Stocks are pointing to a higher opening today with the S&P 500 futures up about 5 points. It is a reasonably dull morning at this point. At the moment, the S&P 500 is failing to get over resistance at 3,253. It will be necessary for the index to get over this region of resistance and not to fail here. The chart mildly has the look of a head and shoulder pattern on the intraday, which is one reason why I want to see the index get over 3,253.

It will be a busy day for economic data though, and that could spice things up. Today at 10 AM we will get Factory Orders, estimates are for a decline of 0.7%. Meanwhile, we will also get the ISM Non-Mfg Index, estimates are for 54.5. That will also give our next GDPNow readout for the fourth quarter.

Daily written analysis, trend identification, market activity reports, and full video access. Recent Analysis

Micron (MU)

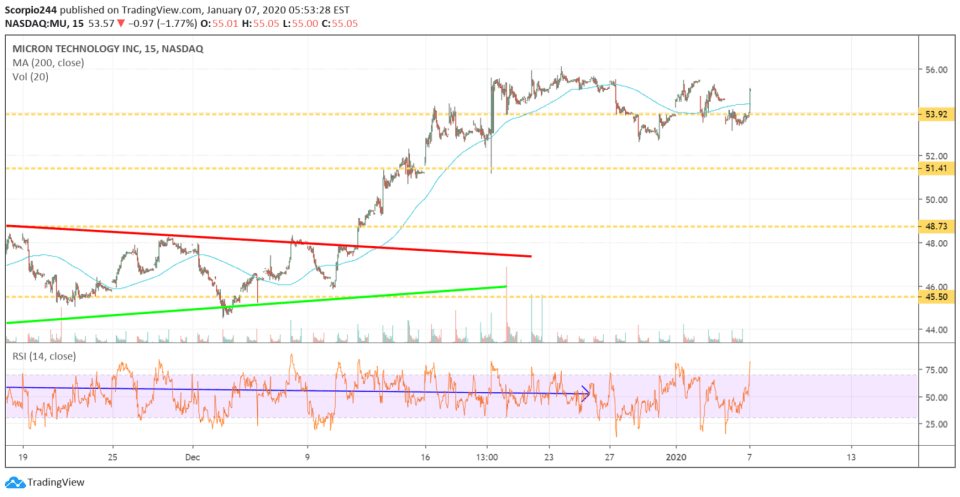

Micron is rising today after it was upgraded by Cowen to Outperform from Market Perform while raising its price target to $70 from $50. The stock has done a reasonably good job of hold support around the $54 level, and it looks like today it might get the chance to break out of this trading range.

Western Digital (WDC)

Western Digital was also upgraded by Cowen today to Outperform from Market Perform, with a price target of $88 from $45. I saw some bullish options betting in this stock last week and combined with the technicals; It seems it could be heading towards $76.

Square (SQ)

Square is moving up, and I continue to think this one is heading higher. It just needs to break this downtrend. – Square’s Stock Is Seeing A Positive Momentum Shift

Netflix (NFLX)

Netflix may also be breaking out of its trading range, and this morning is rising above resistance at $336. A push above $340 starts the process of refilling the gap.

Macy’s (M)

Hey, look at Macy’s rising, and reaching a critical resistance level at $17.40, break that, and the stock can be on its way to $19.50.

Have a great day.

-Mike

Mott Capital Management, LLC is a registered investment adviser. Information presented is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investments, or investment strategies. Investments involve risk and unless otherwise stated, are not guaranteed. Be sure to first consult with a qualified financial adviser and/or tax professional before implementing any strategy discussed herein. Upon request, the advisor will provide a list of all recommendations made during the past twelve months. Past performance is not indicative of future results.

Subscribe to receive this daily commentary directly in your email

This report contains independent commentary to be used for informational and educational purposes only. Michael Kramer is a member and investment adviser representative with Mott Capital Management. Mr. Kramer is not affiliated with this company and does not serve on the board of any related company that issued this stock. All opinions and analyses presented by Michael Kramer in this analysis or market report are solely Michael Kramer’s views. Readers should not treat any opinion, viewpoint, or prediction expressed by Michael Kramer as a specific solicitation or recommendation to buy or sell a particular security or follow a particular strategy. Michael Kramer’s analyses are based upon information and independent research that he considers reliable, but neither Michael Kramer nor Mott Capital Management guarantees its completeness or accuracy, and it should not be relied upon as such. Michael Kramer is not under any obligation to update or correct any information presented in his analyses. Mr. Kramer’s statements, guidance, and opinions are subject to change without notice. Past performance is not indicative of future results. Neither Michael Kramer nor Mott Capital Management guarantees any specific outcome or profit. You should be aware of the real risk of loss in following any strategy or investment commentary presented in this analysis. Strategies or investments discussed may fluctuate in price or value. Investments or strategies mentioned in this analysis may not be suitable for you. This material does not consider your particular investment objectives, financial situation, or needs and is not intended as a recommendation appropriate for you. You must make an independent decision regarding investments or strategies in this analysis. Upon request, the advisor will provide a list of all recommendations made during the past twelve months. Before acting on information in this analysis, you should consider whether it is suitable for your circumstances and strongly consider seeking advice from your own financial or investment adviser to determine the suitability of any investment.

The Market’s Relief Rally Faces A Major Technical Wall W/Broadcom

Mott Capital's Market Chronicles 9 hours ago