Subscribe to receive this daily commentary directly in your email

STOCKS: NFLX, AAPL, TSLA, AMZN, BABA, AMD, ROKU

MACRO: SPY, SMH

MICHAEL KRAMER AND THE CLIENTS OF MOTT CAPITAL OWN NFLX, AAPL, TSLA,

ON FEBRUARY 27 AT 12 PM ET, I WILL CONDUCT A FREE WEBINAR HOSTED BY INTERACTIVE BROKERS, IT IS FREE FOR ALL TO ATTEND. THE TOPIC WILL BE:

Stocks Still Have Much Further To Climb In 2020

SIGN UP NOW!

S&P 500 (SPY)

Stocks will have a holiday-shortened trading week with the market closed for the President’s day holiday on Monday. Stocks left off in a favorable position on Friday, with the S&P 500 closing around 3,380. The next significant level for the index continues to come around 3,400, with an overall longer-term trend to around 3,600.

Daily written analysis, trend identification, market activity reports, and full video access. Recent Analysis

Semis (SMH)

Watch the Semis this week, the group has been on fire, and now the next level of resistance for the SMH appears to come around $160.50.

AMD (AMD)

AMD continues to perform nicely and appears to be on a path that seems to take the stock to $59. I have maintained this view for some time now.

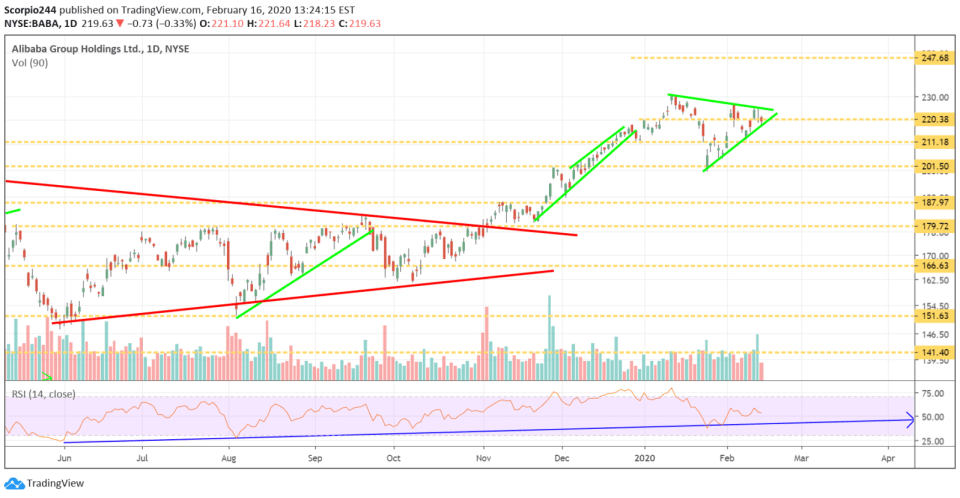

Alibaba (BABA)

I continue to believe that Alibaba is on a path higher, and I think that had the company not report the results on the same day as unfavorable news around the coronavirus shares would have moved higher. The next level of resistance will come around $248.

Netflix (NFLX)

Netflix will continue to battle with what looks like strong technical resistance around $385. It is the fourth time the stock had gotten to this price since breaking down in July 2018. However, this time, the stock has momentum on its side, and an increase above $385 sends shares surging to $400.

Tesla (TSLA)

Tesla held up exceptionally well in the face of the secondary offering and nearly 5% discount on the pricing. I think the stock heads back to $845 this week.

Apple (AAPL)

It looks as if Apple may be forming an ascending triangle, and that could trigger a break out to $348.

Amazon (AMZN)

I don’t think Amazon’s breakaway gap gets filled, and the stock pushes higher towards $2,277.

Roku (ROKU)

Finally, Roku hit my target early Friday morning at $150 and failed at resistance to break out. The stock reversed and finished the day lower. I think the stock results weren’t that great, despite the big beat. I’m afraid shares head lower to $116.

You can read more in my Forbes article: Roku’s Post-Earnings Plunge May Only Be The Start

Have a great day off!

-Mike

Mott Capital Management, LLC is a registered investment adviser. Information presented is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investments, or investment strategies. Investments involve risk and unless otherwise stated, are not guaranteed. Be sure to first consult with a qualified financial adviser and/or tax professional before implementing any strategy discussed herein. Upon request, the advisor will provide a list of all recommendations made during the past twelve months. Past performance is not indicative of future results.

Subscribe to receive this daily commentary directly in your email

This report contains independent commentary to be used for informational and educational purposes only. Michael Kramer is a member and investment adviser representative with Mott Capital Management. Mr. Kramer is not affiliated with this company and does not serve on the board of any related company that issued this stock. All opinions and analyses presented by Michael Kramer in this analysis or market report are solely Michael Kramer’s views. Readers should not treat any opinion, viewpoint, or prediction expressed by Michael Kramer as a specific solicitation or recommendation to buy or sell a particular security or follow a particular strategy. Michael Kramer’s analyses are based upon information and independent research that he considers reliable, but neither Michael Kramer nor Mott Capital Management guarantees its completeness or accuracy, and it should not be relied upon as such. Michael Kramer is not under any obligation to update or correct any information presented in his analyses. Mr. Kramer’s statements, guidance, and opinions are subject to change without notice. Past performance is not indicative of future results. Neither Michael Kramer nor Mott Capital Management guarantees any specific outcome or profit. You should be aware of the real risk of loss in following any strategy or investment commentary presented in this analysis. Strategies or investments discussed may fluctuate in price or value. Investments or strategies mentioned in this analysis may not be suitable for you. This material does not consider your particular investment objectives, financial situation, or needs and is not intended as a recommendation appropriate for you. You must make an independent decision regarding investments or strategies in this analysis. Upon request, the advisor will provide a list of all recommendations made during the past twelve months. Before acting on information in this analysis, you should consider whether it is suitable for your circumstances and strongly consider seeking advice from your own financial or investment adviser to determine the suitability of any investment.

Liquidity, Volatility, and Credit Spreads May Drive The Stock Market - Advanced Topics

Mott Capital's Market Chronicles 103 minutes ago