Subscribe to receive this daily commentary directly in your email

FEBRUARY 27, 2020

STOCKS: ACAD, BABA, MU, AMD, SQ

MARCO: SPY, GOLD, EWG, EWY

MICHAEL KRAMER AND THE CLIENTS OF MOTT CAPITAL OWN ACAD

Stocks are pointing to some more losses this morning, with the S&P 500 futures down to about 3,100, with support on the futures around 3,080. Like I have said, it seems that the 3,110 region appears to be the creation of a bottoming process, and so far, we are still hanging around this region.

The S&P 500 fell to around 3,115 on February 25, 3110, on the 26, and about 3,100 today. So It creates this 15 point region where it seems that at least declines have slowed. So that is roughly a 75 basis point region, and that tends to be how I approach things, looking for regions.

Daily written analysis, trend identification, market activity reports, and full video access. Recent Analysis

Anyway, this is how it looks on the daily change of the S&P 500.

KOSPI (EWY)

You can see this same type of zone that has formed on the Kospi, which is about 1% wide and is an essential level of support around 2,061 that dates back to mid-October.

Germany (DAX)

Again, you can see the same in the DAX, which is also at an essential level of support at its October break out around 12,500.

Gold (GOLD)

Gold prices have hardly moved, and that seems odd to me.

So we can wait and see what happens, nobody has a clue what will happen or when it will end. I’ll probably be proven wrong too, because I’m trying to think in a logical sense, while markets operate in an illogical sense.

Acadia (ACAD)

I thought Acadia is starting to show some strong momentum on Nuplazid sales, and in a normal environment, the stock should trade higher. The company noted on the call that Nuplazid could get an approval in DRP before year-end, due to its breakthrough therapy designation. So will the stock rise? I hope it does; it deserves too. But trying to figure out where this stock goes in a normal trading session is hard enough, let alone in this environment.

Alibaba (BABA)

Alibaba continues to rebound and rise in this environment, which seems unusual. But $211 has been acting as resistance so that it if can clear $211, then perhaps it can move on to $220. If not, back to $200.

AMD (AMD)

AMD is sitting on a support level at $46.80, and that level of support has been firm for some time. This level needs to hold for AMD, or it declines to $43.

Square (SQ)

Square is trading at resistance at $83 following its results, and this may not be a day for the stock to break resistance.

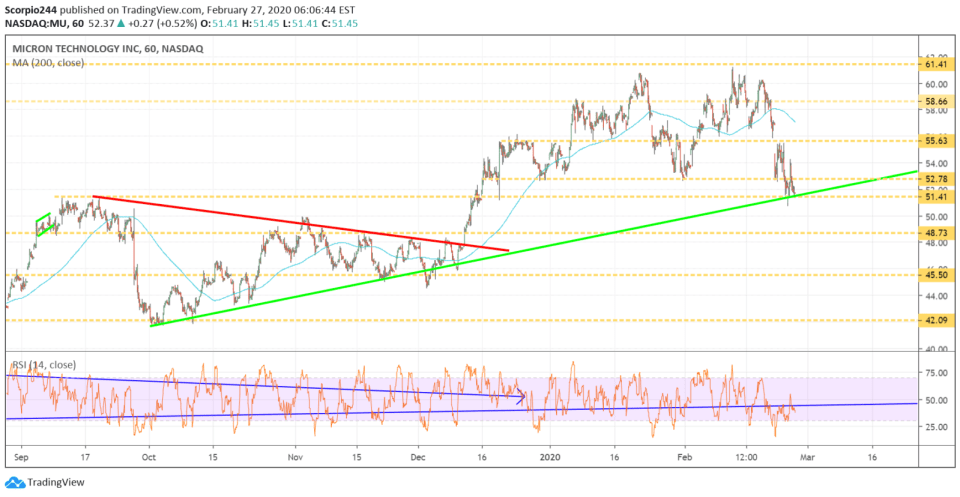

Micron (MU)

Micron is falling some but holding support, and yesterday I noted that I was seeing some bullish betting that shares recover by April. Free – Micron’s Stock May Not Stay Down For Long

My throat is hurting today, ugh.

-Mike

Mott Capital Management, LLC is a registered investment adviser. Information presented is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investments, or investment strategies. Investments involve risk and unless otherwise stated, are not guaranteed. Be sure to first consult with a qualified financial adviser and/or tax professional before implementing any strategy discussed herein. Upon request, the advisor will provide a list of all recommendations made during the past twelve months. Past performance is not indicative of future results.

Subscribe to receive this daily commentary directly in your email

This report contains independent commentary to be used for informational and educational purposes only. Michael Kramer is a member and investment adviser representative with Mott Capital Management. Mr. Kramer is not affiliated with this company and does not serve on the board of any related company that issued this stock. All opinions and analyses presented by Michael Kramer in this analysis or market report are solely Michael Kramer’s views. Readers should not treat any opinion, viewpoint, or prediction expressed by Michael Kramer as a specific solicitation or recommendation to buy or sell a particular security or follow a particular strategy. Michael Kramer’s analyses are based upon information and independent research that he considers reliable, but neither Michael Kramer nor Mott Capital Management guarantees its completeness or accuracy, and it should not be relied upon as such. Michael Kramer is not under any obligation to update or correct any information presented in his analyses. Mr. Kramer’s statements, guidance, and opinions are subject to change without notice. Past performance is not indicative of future results. Neither Michael Kramer nor Mott Capital Management guarantees any specific outcome or profit. You should be aware of the real risk of loss in following any strategy or investment commentary presented in this analysis. Strategies or investments discussed may fluctuate in price or value. Investments or strategies mentioned in this analysis may not be suitable for you. This material does not consider your particular investment objectives, financial situation, or needs and is not intended as a recommendation appropriate for you. You must make an independent decision regarding investments or strategies in this analysis. Upon request, the advisor will provide a list of all recommendations made during the past twelve months. Before acting on information in this analysis, you should consider whether it is suitable for your circumstances and strongly consider seeking advice from your own financial or investment adviser to determine the suitability of any investment.

NVIDIA Crushed Following Earnings

Mott Capital's Market Chronicles 23 hours ago