Subscribe to receive this daily commentary directly in your email

July 15, 2020

STOCKS – AMZN, NVDA, SPLK

MACRO – QQQ, IWM

I wrote this on my iPhone sorry for typos etc…

Mike Reading The Markets Premium Content – $35/Month or $300/Year

- Warnings Signs Grow

- Amazon Traders Betting Shares Plunge Following Results

- Bearish Bets In Nvidia Continue

- Sell-Off May Be Closer To The Begin Than The End

- SPY VS QQQ – NEED TO KNOW

- Nasdaq 100 Facing More Losses – Morning

- Stocks Turn Eurphoic- Midday

- Bearish Betting Persist For NVIDIA

- Gap Higher, Then Fill? – Morning Commentary

- NASDAQ IS RIPE FOR A SIZEABLE DROP – WEEK AHEAD

- JPM May Jump As Much As 10% Followings Its Quarterly Results

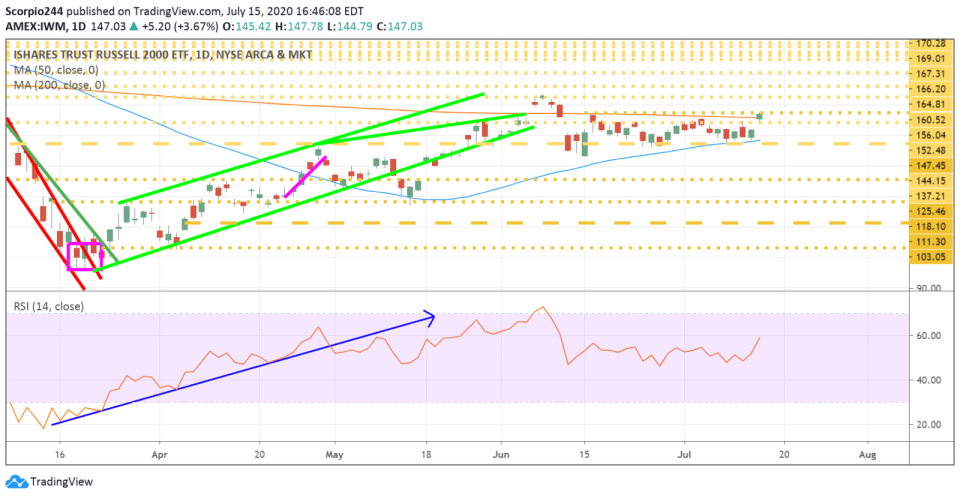

Stocks jumped higher today on the new news about the old news from Moderna and its vaccine. The Russell IWM ETF was the best performing index, and to some degree, that does make sense given the news we already knew from Moderna.

It is kind of odd how Moderna rose just slightly more than the IWM. It kind of tells you how the Moderna news was not that stimulating. Look, I’d love a vaccine, but I want real data that shows real efficacy and safety. Not some fluff piece based on phase 1 hope, I have seen too many drugs produce significant Phase 1 hope to fail in Phase 3.

The IWM was strong but failed when it had to break out. So we’re left to wonder if the IWM can break out and push higher. Daily written analysis, trend identification, market activity reports, and full video access. Recent Analysis

The Qs have been struggling this week. They ran up way too much. There is nothing wrong with a healthy pullback to the lower end of the channel. Option betting has been bearish since last week, so I think one needs to remain on guard.

Amazon (AMZN)

Amazon saw some bearish betting, too, just today. The company never cares about meeting wall streets expectation, and it has served them well. The stock is likely to continue lower, probably to around 2800. (premium content – Amazon Traders Betting Shares Plunge Following Results)

Nvidia (NVDA)

The bearish bets for NVIDIA continue to pile up. I still think this one goes to 380, maybe lower.

Splunk (SPLK)

Meanwhile, Splunk continues to look very weak. If this software sector goes, the market may be in trouble. I think Splunk does go lower to around $170. (Premium content – Warnings Signs Grow)

Mike

Mott Capital Management, LLC is a registered investment adviser. Information presented is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investments, or investment strategies. Investments involve risk and, unless otherwise stated, are not guaranteed. Be sure to first consult with a qualified financial adviser and/or tax professional before implementing any strategy discussed herein. Upon request, the advisor will provide a list of all recommendations made during the past twelve months. Past performance is not indicative of future results.

Subscribe to receive this daily commentary directly in your email

This report contains independent commentary to be used for informational and educational purposes only. Michael Kramer is a member and investment adviser representative with Mott Capital Management. Mr. Kramer is not affiliated with this company and does not serve on the board of any related company that issued this stock. All opinions and analyses presented by Michael Kramer in this analysis or market report are solely Michael Kramer’s views. Readers should not treat any opinion, viewpoint, or prediction expressed by Michael Kramer as a specific solicitation or recommendation to buy or sell a particular security or follow a particular strategy. Michael Kramer’s analyses are based upon information and independent research that he considers reliable, but neither Michael Kramer nor Mott Capital Management guarantees its completeness or accuracy, and it should not be relied upon as such. Michael Kramer is not under any obligation to update or correct any information presented in his analyses. Mr. Kramer’s statements, guidance, and opinions are subject to change without notice. Past performance is not indicative of future results. Neither Michael Kramer nor Mott Capital Management guarantees any specific outcome or profit. You should be aware of the real risk of loss in following any strategy or investment commentary presented in this analysis. Strategies or investments discussed may fluctuate in price or value. Investments or strategies mentioned in this analysis may not be suitable for you. This material does not consider your particular investment objectives, financial situation, or needs and is not intended as a recommendation appropriate for you. You must make an independent decision regarding investments or strategies in this analysis. Upon request, the advisor will provide a list of all recommendations made during the past twelve months. Before acting on information in this analysis, you should consider whether it is suitable for your circumstances and strongly consider seeking advice from your own financial or investment adviser to determine the suitability of any investment.

A Surging Dollar, Negative Gamma, and the Battle Over 6,800

Mott Capital's Market Chronicles 4 hours ago