Subscribe to receive this daily commentary directly in your email

STOCKS – BA, AAPL, MSFT, AMZN, W

MACRO – SPY, XLI, VIX

Michael Kramer and the clients of Mott Capital own AAPL, MSFT, GOOGL

Stocks had a good day recouping all of there loss from last week and then some. The S&P 500 managed to finish around 2955, but in a precarious spot. Again, these are merely the facts, look at them; however, you please. The index managed to close pretty much right on the lower trend line of the rising wedge from we identified over the past two weeks.

So it is simple, as I explained in a video for subscribers, if the S&P 500 can push through that uptrend, then it stands a chance to race towards 3100. If it does, fail to push through that uptrend, then it likely looks to fill the gap and potentially more. I’m not saying it will or won’t. I do not know. (Premium content – 3100 Or Bust – Quite Literally)

It would have been ideal for the RSI to push to a new high, to confirm today’s gains, but it did not. Typically, that is not a bullish sign, but based on how things finished, I’d call it a push.

Daily written analysis, trend identification, market activity reports, and full video access. Recent Analysis

It would have also been nice for the VIX to make a lower low, but it did not.

Amazon was also unable to push to a new high, and its RSI still suggests the stock heads lower.

Microsoft also failed to make a new high, and its RSI is still pointing lower.

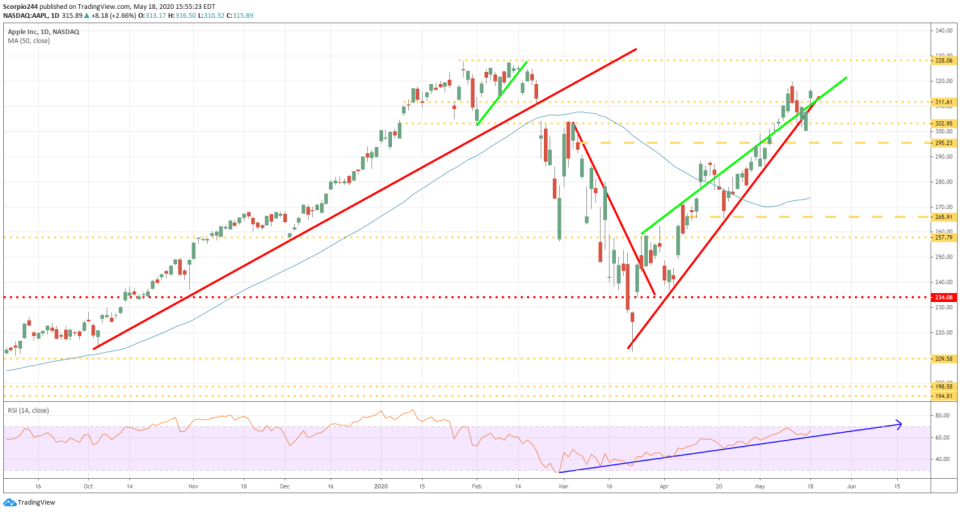

Apple also failed to make a new high, and its RSI is also pointing to lower.

Anyway, I’m not going to go through the others because they are unchanged. So while it is fantastic that industrial rallied today, does it matter? Besides, the ETF failed precisely where it has failed three other times.

What does it matter Boeing was up 13% today when it still down about 17% from April 8.

Wayfair (W)

Then, of course, you have Wayfair which got smoked today. I said $122 the last time, I wrote, but I think i misjudged the gap, it should have been $134. What is $8, when there is another 13% or so potentially to the downside? Some breakaway gap, what a joke…

Anyway, it is what it is, have a good one.

-Mike

Mott Capital Management, LLC is a registered investment adviser. Information presented is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investments, or investment strategies. Investments involve risk and, unless otherwise stated, are not guaranteed. Be sure to first consult with a qualified financial adviser and/or tax professional before implementing any strategy discussed herein. Upon request, the advisor will provide a list of all recommendations made during the past twelve months. Past performance is not indicative of future results.

Subscribe to receive this daily commentary directly in your email

This report contains independent commentary to be used for informational and educational purposes only. Michael Kramer is a member and investment adviser representative with Mott Capital Management. Mr. Kramer is not affiliated with this company and does not serve on the board of any related company that issued this stock. All opinions and analyses presented by Michael Kramer in this analysis or market report are solely Michael Kramer’s views. Readers should not treat any opinion, viewpoint, or prediction expressed by Michael Kramer as a specific solicitation or recommendation to buy or sell a particular security or follow a particular strategy. Michael Kramer’s analyses are based upon information and independent research that he considers reliable, but neither Michael Kramer nor Mott Capital Management guarantees its completeness or accuracy, and it should not be relied upon as such. Michael Kramer is not under any obligation to update or correct any information presented in his analyses. Mr. Kramer’s statements, guidance, and opinions are subject to change without notice. Past performance is not indicative of future results. Neither Michael Kramer nor Mott Capital Management guarantees any specific outcome or profit. You should be aware of the real risk of loss in following any strategy or investment commentary presented in this analysis. Strategies or investments discussed may fluctuate in price or value. Investments or strategies mentioned in this analysis may not be suitable for you. This material does not consider your particular investment objectives, financial situation, or needs and is not intended as a recommendation appropriate for you. You must make an independent decision regarding investments or strategies in this analysis. Upon request, the advisor will provide a list of all recommendations made during the past twelve months. Before acting on information in this analysis, you should consider whether it is suitable for your circumstances and strongly consider seeking advice from your own financial or investment adviser to determine the suitability of any investment.

Volatility Crush Sends Stocks Higher Even As Oil And Rates Surge

Mott Capital's Market Chronicles 10 hours ago