Subscribe to receive this daily commentary directly in your email

October 6, 2020

STOCKS – AMZN, FB, BA, DOCU

Macro – SPY, QQQ

Mike’s Reading The Markets (RTM) Premium Content – NOW WITH A 2 WEEK FREE TRIAL

- Biden’s Lead Over Trump May Not Be As Big As It Seems

- Stocks Come Close To Breaking, But Not Yet

- Stocks Will Test Resistance

- How To Find Technical Trends And Levels

- Re-Testing

- APPLE’S STOCK FACES FURTHER LOSSES BASED ON OPTIONS BETTING

Stocks fell hard today after President Trump decided to stop negotiations on a stimulus. It should be no surprise; it seemed like an impossible task to get done a month before an election. But clearly, the market was pricing in a stimulus; you saw it in the bond market and the dollar, as well as equity prices. So this will lead to an unwind of those moves.

Dollar Index (UUP)

The dollar index jumped sharply following the news, and with the ECB’s focus on the euro currency, it seems that it may only be a matter of time until the dollar’s moves to higher levels. Daily written analysis, trend identification, market activity reports, and full video access. Recent Analysis

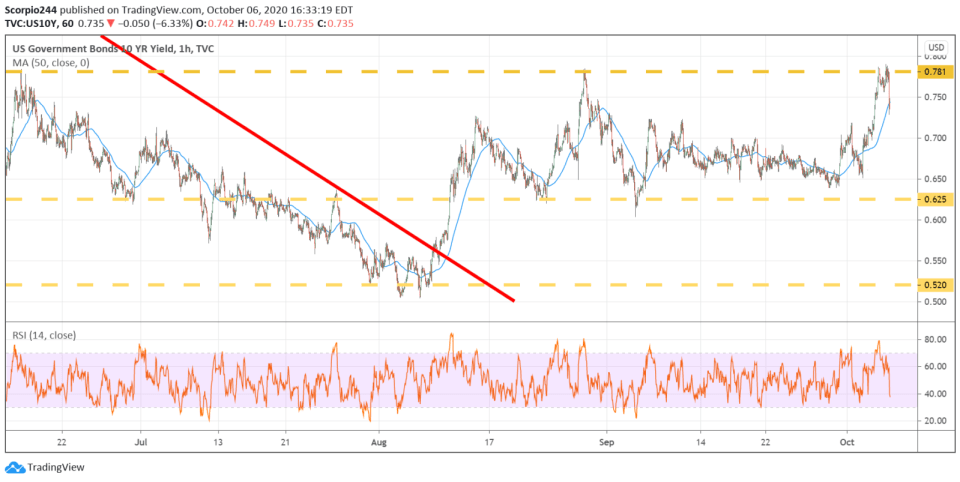

10-Year

We also saw the 10-year fail at resistance, turn lower on the news, and is likely heading back 63 bps.

S&P 500 (SPY)

The S&P 500 got to resistance at 3,425, and just when it looked like it might break higher, the news hit the Twitter feed, and the algo’s flipped. We fell right through the lower trend line of the bear flag, and we managed to see the re-test of that break down right away. It suggests that the next level we should be watching for is around 3,340, and probably the September lows around 3,220 after that.

NASDAQ 100 (QQQ)

The Qs fell out of their bear flag today as well and back to support at $274.30. I wouldn’t be surprised if we fell back to $264 over the next few days.

Amazon (AMZN)

Amazon fell pretty hard, too, dropping to below $3,100. Again, it had the same pattern as the indexes, so the decline doesn’t surprise. The next stop is likely $3,000.

Boeing (BA)

Boeing said it expects sales of its plane to be hurt for more than a decade. I’m surprised the stock hasn’t gone to even lower levels. It probably revisits $145, but why couldn’t go even lower, like the $120’s?

Facebook (FB)

If Facebook breaks $245, one could almost argue that it has formed a head and shoulder pattern. That would not be good for the stock.

DocuSign (DOCU)

I really would love to see Docusign break already. The stock’s valuation is beyond insane, and that RSI keeps going lower and lower. There is that little uptrend that needs to go; then, we can retest $190.

-Mike

Mott Capital Management, LLC is a registered investment adviser. Information presented is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investments, or investment strategies. Investments involve risk and, unless otherwise stated, are not guaranteed. Be sure to first consult with a qualified financial adviser and/or tax professional before implementing any strategy discussed herein. Upon request, the advisor will provide a list of all recommendations made during the past twelve months. Past performance is not indicative of future results.

Subscribe to receive this daily commentary directly in your email

This report contains independent commentary to be used for informational and educational purposes only. Michael Kramer is a member and investment adviser representative with Mott Capital Management. Mr. Kramer is not affiliated with this company and does not serve on the board of any related company that issued this stock. All opinions and analyses presented by Michael Kramer in this analysis or market report are solely Michael Kramer’s views. Readers should not treat any opinion, viewpoint, or prediction expressed by Michael Kramer as a specific solicitation or recommendation to buy or sell a particular security or follow a particular strategy. Michael Kramer’s analyses are based upon information and independent research that he considers reliable, but neither Michael Kramer nor Mott Capital Management guarantees its completeness or accuracy, and it should not be relied upon as such. Michael Kramer is not under any obligation to update or correct any information presented in his analyses. Mr. Kramer’s statements, guidance, and opinions are subject to change without notice. Past performance is not indicative of future results. Neither Michael Kramer nor Mott Capital Management guarantees any specific outcome or profit. You should be aware of the real risk of loss in following any strategy or investment commentary presented in this analysis. Strategies or investments discussed may fluctuate in price or value. Investments or strategies mentioned in this analysis may not be suitable for you. This material does not consider your particular investment objectives, financial situation, or needs and is not intended as a recommendation appropriate for you. You must make an independent decision regarding investments or strategies in this analysis. Upon request, the advisor will provide a list of all recommendations made during the past twelve months. Before acting on information in this analysis, you should consider whether it is suitable for your circumstances and strongly consider seeking advice from your own financial or investment adviser to determine the suitability of any investment.

Oil Uncertainty and Options Positioning Shape the Market’s Next Move

Mott Capital's Market Chronicles 85 minutes ago