Subscribe to receive this daily commentary directly in your email

MARCH 25, 2020

STOCKS: TSLA, NVDA, SQ, BA, BABA

MACRO: SPY, VIX

MICHAEL KRAMER AND THE CLIENTS OF MOTT CAPITAL OWN TESLA

Mike’s Reading The Market Premium Service – Recent Titles:

- Strange Times For Sure – Midday 3.25.20

- Stocks Giving Back Over Night Gains – Morning Commentary 3.25.20

- The Virus Will Leave A Lasting Path Of Destruction

- Stocks Massive Rally, But Concerns Remain

Stocks managed to give back nearly 75% of their gains in the final 10 minutes of trading, making it a pretty horrible close. As I noted at the days end in chat, this market can not be trusted. Luckily the index managed to still close higher on the day by 1%, but it had been up by almost 5% at its highs. Ok, so really it gave back nearly 4/5 of its gains, or 80%, still working on fractions for homeschooling, sorry, it’s stuck in my head.

S&P 500 (SPY)

The bad news here is that the index failed to get over 2,550 and also broke the mini-channel that formed over the past few days. I fear this is setting us for something pretty devasting to finish out the week. It would be demoralizing for sure, and that means we probably fill the gap back to 2,270.

Daily written analysis, trend identification, market activity reports, and full video access. Recent Analysis

VIX

The VIX rose today, and there is something brewing there, and I’d almost hate to say it, but it looks like it could be a bullish continuation flag. That means the VIX could be gearing up to go even higher! Anyone at 96?

Anyway, sorry. Maybe I will be wrong, it does happen.

Tesla (TSLA)

Tesla had a nice move higher and is now consolidating. I think it continues to push higher, perhaps back to $600. It strange, considering my bearish stance on the overall market, but I’m basing it off the charts.

Nvidia (NVDA)

Nvidia failed at resistance today at $262, and that one appears it could head lower again back to around $215.

Square (SQ)

Square filled a gap, and it appears it is either going to move lower again or perhaps form a cup and handle pattern. Either way, over the short term, the stock is likely finished rising.

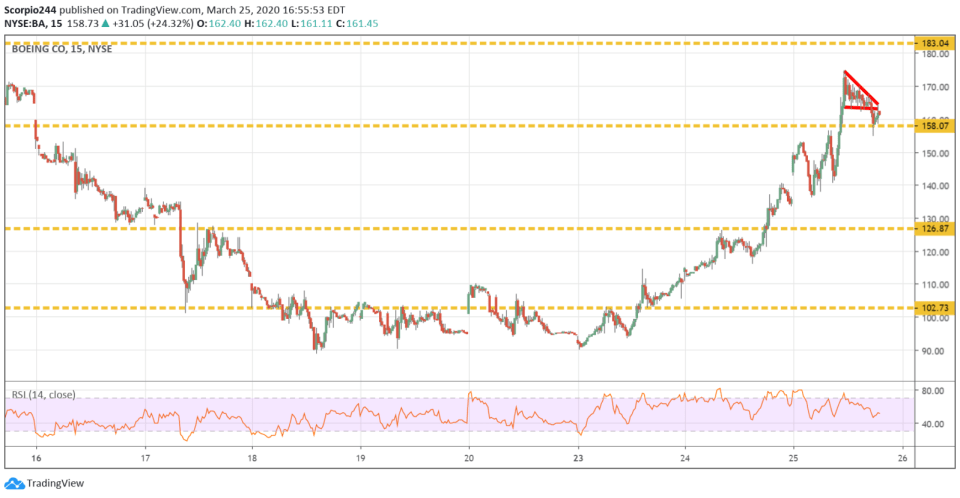

Boeing (BA)

Interestingly Boeing has a similar pattern. Uh-oh.

Alibaba (BABA)

Alibaba has a bullish pattern with that falling wedge and rising RSI. Perhaps it moves back to $201.

Anyway, have a good night!

-Mike

Mott Capital Management, LLC is a registered investment adviser. Information presented is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investments, or investment strategies. Investments involve risk and unless otherwise stated, are not guaranteed. Be sure to first consult with a qualified financial adviser and/or tax professional before implementing any strategy discussed herein. Upon request, the advisor will provide a list of all recommendations made during the past twelve months. Past performance is not indicative of future results.

Subscribe to receive this daily commentary directly in your email

This report contains independent commentary to be used for informational and educational purposes only. Michael Kramer is a member and investment adviser representative with Mott Capital Management. Mr. Kramer is not affiliated with this company and does not serve on the board of any related company that issued this stock. All opinions and analyses presented by Michael Kramer in this analysis or market report are solely Michael Kramer’s views. Readers should not treat any opinion, viewpoint, or prediction expressed by Michael Kramer as a specific solicitation or recommendation to buy or sell a particular security or follow a particular strategy. Michael Kramer’s analyses are based upon information and independent research that he considers reliable, but neither Michael Kramer nor Mott Capital Management guarantees its completeness or accuracy, and it should not be relied upon as such. Michael Kramer is not under any obligation to update or correct any information presented in his analyses. Mr. Kramer’s statements, guidance, and opinions are subject to change without notice. Past performance is not indicative of future results. Neither Michael Kramer nor Mott Capital Management guarantees any specific outcome or profit. You should be aware of the real risk of loss in following any strategy or investment commentary presented in this analysis. Strategies or investments discussed may fluctuate in price or value. Investments or strategies mentioned in this analysis may not be suitable for you. This material does not consider your particular investment objectives, financial situation, or needs and is not intended as a recommendation appropriate for you. You must make an independent decision regarding investments or strategies in this analysis. Upon request, the advisor will provide a list of all recommendations made during the past twelve months. Before acting on information in this analysis, you should consider whether it is suitable for your circumstances and strongly consider seeking advice from your own financial or investment adviser to determine the suitability of any investment.

The Next Leg Lower Nears...

Mott Capital's Market Chronicles February 27, 2026 1:57 PM