Subscribe to receive this daily commentary directly in your email

January 10, 10:15 PM

Stocks: NFLX, ROKU, INTC, AMD

Macro: Jobs, SPY, IWM

Reading The Markets Premium Content From January 10, 2020

- Betting Suggests Intel’s Stock Makes A Big Jump

- STOCKS STALL AFTER JOB REPORT – MIDDAY UPDATE 1.10.20

- Mentions: BYND, IWM, MU, NFLX, ROKU, SPY, SQ, TWTR, WDC

- MORNING COMMENTARY – JOBS FRIDAY

MICHAEL KRAMER AND THE CLIENTS OF MOTT CAPITAL OWN NFLX

Wow, stocks do go down. It’s been so long, I have forgotten how it feels. But indeed, that is what happened on January 10; the S&P 500 fell by 30 basis points to close the week at 3,265.

I noted in my audio morning commentary for paying subscribers, which comes out every day, about 30 minutes before the market open, that I thought the jobs data was market neutral. There was nothing in it that was overly concerning, which would suggest the economy is slowing. But there was nothing there to indicate that the economy was reaccelerating either. Premium content- MORNING COMMENTARY – JOBS FRIDAY

The most exciting thing I saw was that wage growth fell to 2.9%, which was below estimates for 3.1%.

Where I went wrong in my morning analysts looking for 225,000 jobs created, was that I thought the pace of employment would rise y/y, but instead, it fell. Oh well, I tried.

Daily written analysis, trend identification, market activity reports, and full video access. Recent Analysis

Meanwhile, GDPNow remained unchanged at 2.3%. The next reading is due on January 16, when retails sales are reported.

S&P 500 (SPY)

Nothing changed technical for the S&P 500 today, the break out held. The RSI fell to 67, good enough for me.

S&P vs. Russell

The following chart kind of confirms my assessment yesterday about the divergence between the S&P 500 and the Russell. The chart shows the number of stocks in the S&P 500 above their 200 day moving average, versus the number of total stocks above their 200 day moving. It certainly appears that the spread has widened some in recent weeks, with the S&P 500 around 82%, and the total market around 63%.

When you do the actual math with the S&P 500 minus the total market, the spread is on the upper end of the historical range. I’m not sure if that means the number of stocks in the S&P 500 falls to the total market or the other way around. But either way, it is due for a reversion, wouldn’t you think?

I talked more about the Russell today, in the midday audio file, and why I thought it might be due to rise. Premium content- STOCKS STALL AFTER JOB REPORT – MIDDAY UPDATE 1.10.20

Intel (INTC)

I have noticed some bullish options betting in Intel that suggests the stock may be getting ready to jump higher. Premium content- Betting Suggests Intel’s Stock Makes A Big Jump

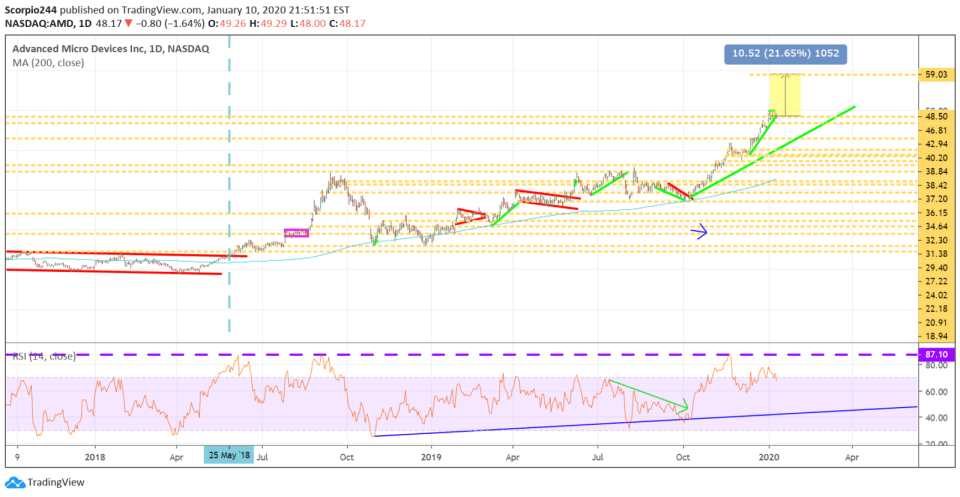

AMD (AMD)

I also noted that I saw a lot of bullish betting in AMD recently, which suggests the stock rises to, are you ready? $62. You can read the Free article here – AMD’s Bulls Are Growing Even More Bullish

Roku (ROKU)

Well, that descending triangle in Roku is looking a lot more real tonight, now isn’t it? That support has to hold come Monday or else the stock is heading to $122, and probably lower.

Netflix (NFLX)

I do not know what happened to Netflix; I was so sure it would start filling the gap this time. Now, look. The trend remains higher, but now I fear it must first fall to $322 or maybe even $315.

Anyway, more tomorrow, maybe, we’ll see how my day goes.

-Mike

Mott Capital Management, LLC is a registered investment adviser. Information presented is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investments, or investment strategies. Investments involve risk and unless otherwise stated, are not guaranteed. Be sure to first consult with a qualified financial adviser and/or tax professional before implementing any strategy discussed herein. Upon request, the advisor will provide a list of all recommendations made during the past twelve months. Past performance is not indicative of future results.

Subscribe to receive this daily commentary directly in your email

This report contains independent commentary to be used for informational and educational purposes only. Michael Kramer is a member and investment adviser representative with Mott Capital Management. Mr. Kramer is not affiliated with this company and does not serve on the board of any related company that issued this stock. All opinions and analyses presented by Michael Kramer in this analysis or market report are solely Michael Kramer’s views. Readers should not treat any opinion, viewpoint, or prediction expressed by Michael Kramer as a specific solicitation or recommendation to buy or sell a particular security or follow a particular strategy. Michael Kramer’s analyses are based upon information and independent research that he considers reliable, but neither Michael Kramer nor Mott Capital Management guarantees its completeness or accuracy, and it should not be relied upon as such. Michael Kramer is not under any obligation to update or correct any information presented in his analyses. Mr. Kramer’s statements, guidance, and opinions are subject to change without notice. Past performance is not indicative of future results. Neither Michael Kramer nor Mott Capital Management guarantees any specific outcome or profit. You should be aware of the real risk of loss in following any strategy or investment commentary presented in this analysis. Strategies or investments discussed may fluctuate in price or value. Investments or strategies mentioned in this analysis may not be suitable for you. This material does not consider your particular investment objectives, financial situation, or needs and is not intended as a recommendation appropriate for you. You must make an independent decision regarding investments or strategies in this analysis. Upon request, the advisor will provide a list of all recommendations made during the past twelve months. Before acting on information in this analysis, you should consider whether it is suitable for your circumstances and strongly consider seeking advice from your own financial or investment adviser to determine the suitability of any investment.

Volatility Crush Sends Stocks Higher Even As Oil And Rates Surge

Mott Capital's Market Chronicles 13 hours ago