August 13, 2020

STOCKS – AMZN, MU, NFLX, UBER

MACRO – SPY, QQ

Mike’s Reading The Markets (RTM) Premium Content – NOW WITH A 2 WEEK FREE TRIAL

- Warning Signs

- The Message Remains Unchanged, The Market Has Limited Upside

- S&P 500 At THE Critical Moment

- Risk-On Still Under Stress

- Rotation Still In Force, Watch Tech Carefully

- AMD’s Overextended Stock Could Drop 7.5%

- For Now, Rotation Trade Is Keeping S&P 500 Afloat

Stocks were mixed today, with the S&P 500 falling 20 bps and the NASDAQ 100 rising 20 bps. But it was worse than the number let on because the NASDAQ 100 had been up by over 1% on the day, only to give it all back. Meanwhile, the S&P 500 still has that giant gap to fill from the other day.

When looking around the market place, nothing is supporting this moving higher, and I’m not referring to fundamentals. Options betting remains bearish, and there have been very few bets building for higher prices on the S&P 500. Copper was smoked today, falling by 3.3%, and below $2.80. The significant gains from the financials and industrial have vanished, and the XLK was up by just ten bps. Volume levels were low today as well. (PREMIUM CONTENT – The Message Remains Unchanged, The Market Has Limited Upside)

S&P 500 (SPY)

The SPX has been unable to push through resistance around 3,385 and is likely to fill that gap tomorrow around 3,340 or so.

Additionally, the RSI in the SPX is now rolling over, and it could suggest a change in trend is here.

Nasdaq (QQQ)

The Qs rose to resistance at $275.50 and failed to push higher, not a good sign at all. The RSI is now clearly trending lower as well, and that is a negative sign as well.

Overall, the movement in the market seems to suggest it is completely worn out, buyers are exhausted, and a change in trend is not only coming but is likely here. I think it may be pretty much over for now. Copper is telling us the big run is over.

Junk bonds are telling us it is over.

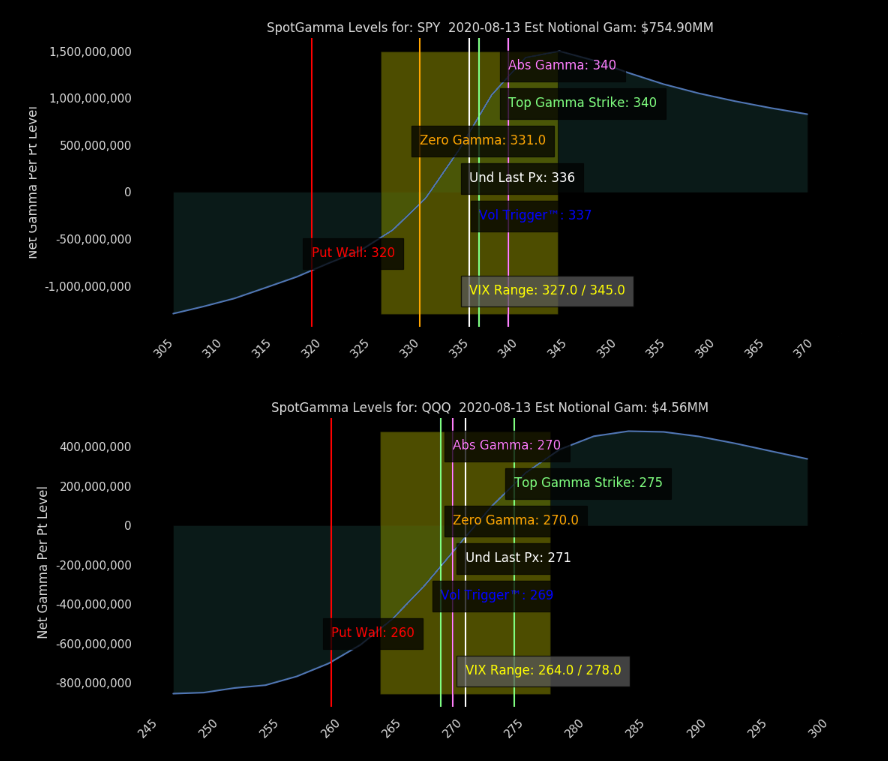

Even gamma levels are telling us it is about over. The high strike $340 level on the SPY has hardly moved higher since August 7’s, reading at $335. Meanwhile, the Q’s haven’t seen their high gamma strike price rise above $275 since August 6. It means nobody is rolling their bets higher; it means the options market is not anticipating higher prices.

Amazon (AMZN)

Amazon failed at the downtrend today and is likely moving lower still and a date at the uptrend line around 3,000. That RSI is telling you the next major in Amazon is lower, not higher.

Netflix (NFLX)

Netflix has broken its uptrend on the chart and the RSI. The next significant level is $450.

Micron (MU)

Micron came within my margin of error, falling to $45.90. I had been looking for $45.50. (Premium content – Bets Pile Up Micron Falls As Much As 10% – FROM JULY 29)

Uber (UBER)

Uber’s chart looks flat out scary with a chance for the shares to fall to around $28.30.

See you

-Mike

Mott Capital Management, LLC is a registered investment adviser. Information presented is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investments, or investment strategies. Investments involve risk and, unless otherwise stated, are not guaranteed. Be sure to first consult with a qualified financial adviser and/or tax professional before implementing any strategy discussed herein. Upon request, the advisor will provide a list of all recommendations made during the past twelve months. Past performance is not indicative of future results.