[widget id=”text-22″]

Where Do Netflix, Amazon, AMD, Micron, and Facebook Go From Here?

Michael Kramer and the clients of Mott Capital own NFLX

[widget id=”text-19″]

[widget id=”wordads_sidebar_widget-55″]

Netflix (NFLX)

Broader Market

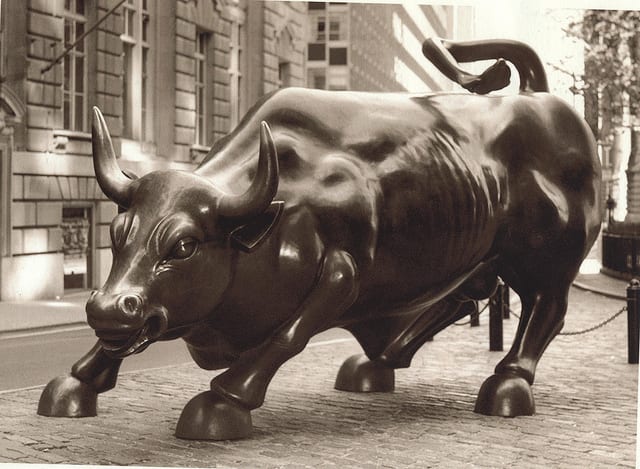

The equity market seems fine, tariffs or no tariffs. Earnings are around the corner, and all the talk and the wringing of the hands around tariffs will total thrown out the window. Sure, the tariffs may add some price inflation, or maybe manufacturers will shift operations to other locations to avoid the tariffs. But remember, China is much more dependent on the U.S. for trade than we are of them. Look at the chart of the Shanghai composite. We have been watching it with great interest because of it being so close to breaking down.

Even stocks in Hong Kong have been crushed. They too are on the cusp of a major breakdown.

I did note in the subscriber section, there are a couple of things to pay close attention too over the next couple of days, that could cause a problem for stocks.

Are Red Flags Emerging For Stocks? Plus AMD Breaking Down

One-Liners

Amazon (AMZN)

Yesterday I noted that Amazon (AMZN) looked as if it was heading lower, well I’m flipping. No, that is a joke. I’m not flipping, in fact, the price action today was even more convincing. Amazon rose back to the uptrend then and it failed. Again the risk for Amazon is lower, and the first level of support remains at $1,840.

AMD (AMD)

AMD (AMD) is holding on to its uptrend by a thread. A fall below the uptrend sends shares lower to $29.50.

Micron (MU)

How critical is $45.25 for Micron (MU), so much so, that the stock rose a little bit above that price, and the sellers came in and kept it from rising the rest of the day. I’ll be honest at this point; I can make a case for the stock rising to $51, or falling to $36. Man earnings can’t come soon enough. Perhap’s we get a sense tomorrow, for which way it goes from here.

Facebook (FB)

Facebook (FB) was down again today, and is now at $160. It is creeping up to support at $159.50. It has a long way to go if support fails.

That is it!

-Mike

Subscriber Video’s

Michael Kramer is the Founder of Mott Capital and the creator of Reading the Markets.

2 Stocks To Consider If You Like Square

Big Biotech Breakout, Plus iPhone Super Cycle Maybe This Year!

Biotech And Semis Breaking Out?

[widget id=”text-28″]

SPY, AMZN, NFLX, AMD, FB, MU, FXI